In 2018, the Philippine economy grew at a slower pace compared to 2017 at 6.2%, but it is still among the fastest in Asia. Despite the rise in inflation which tempered household consumption and investment spending, the economy remained resilient as the construction sector provided the much-needed stimulant to the economy driven by the government’s aggressive Build Build Build program. The economy was also supported by OFW remittances which grew at a modest 3%, the influx of tourists and continuous growth of the business process outsourcing sector as well as other business sectors. In addition, the Philippines’ young demographics and consumption-driven market are also drivers of the country’s long-term growth. It is with all these that we expect the Philippine property sector to continue to grow.

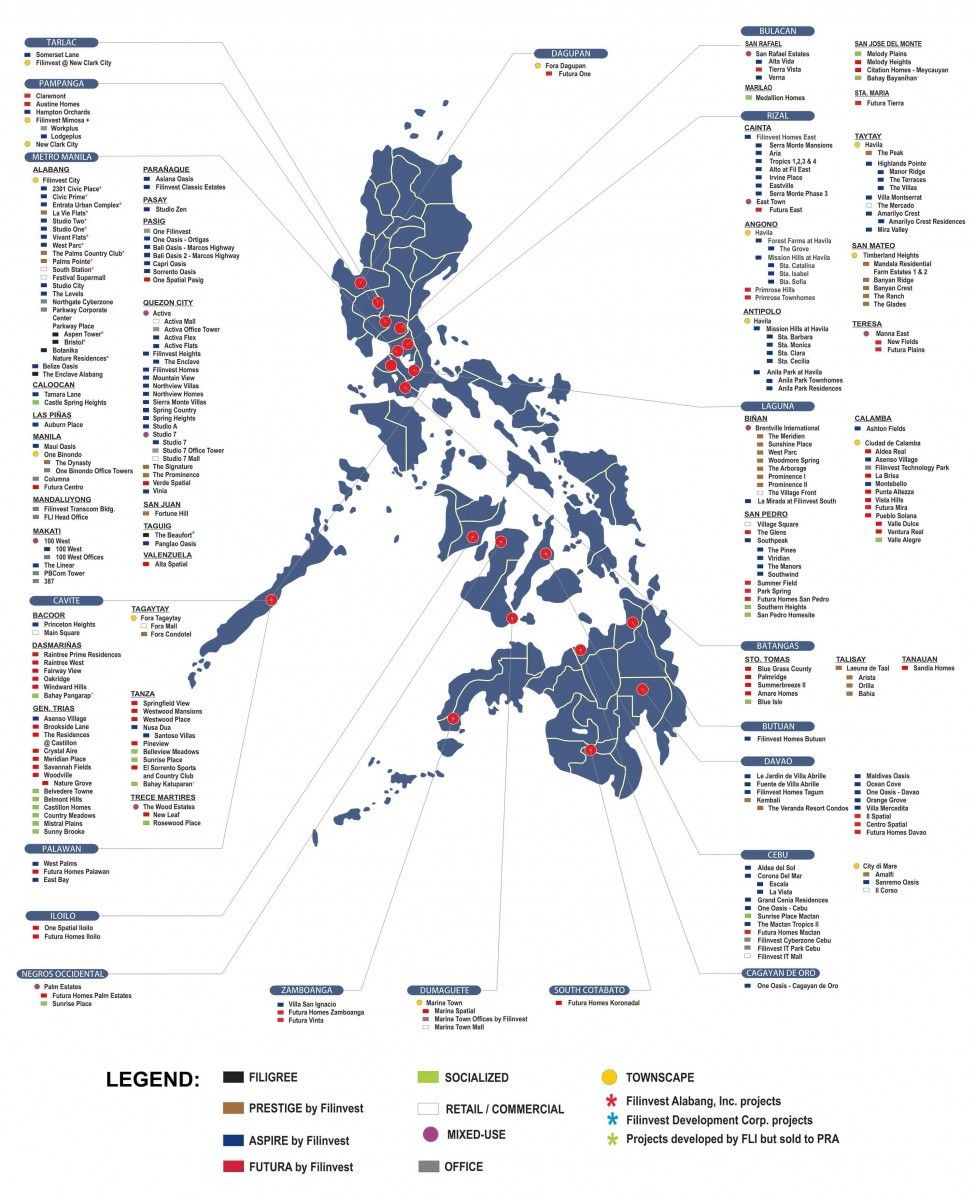

In 2018, we saw a lot of infrastructure activities which we believe will help in accelerating growth for the country, as well as your Company. New roads and transportation systems will open new opportunities for the residential business as accessibility is improved. Our vast land bank will benefit from the infrastructure projects of the government.

Your Company expects the office rental business to continue to grow with BPO demand for office space increasing in 2018. Demand from traditional as well as non-traditional firms is also growing.

EXECUTING OUR GROWTH STRATEGY

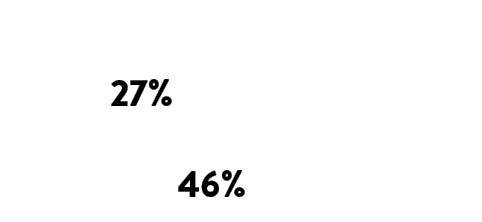

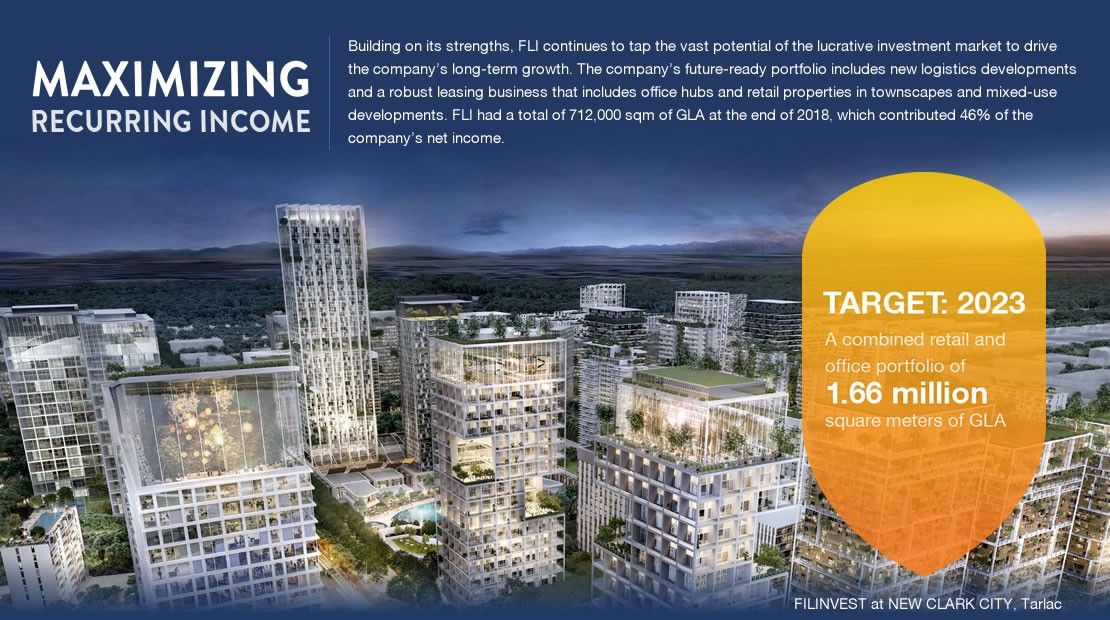

At the end of 2018, the fourth year of our 5-year expansion program, our recurring income portfolio reached 712,000 square meters. The rental business now accounts for 46% of the company’s total net income. For 2019, we expect to add 240,000 square meters of gross leasable area in office and retail space. We believe that this will bring us to accelerated growth in the succeeding years as we complete our 5-year accelerated expansion plan.

We continue to plan for further expansion by targeting an additional 600,000 square meters of GLA by 2023.

Your Company will also be expanding to logistics and industrial parks by providing large spaces needed by logistics and light manufacturing companies, initially in the township in New Clark City.

Your Company also launched Php16 billion worth of residential projects across the country catering primarily to the affordable and middle income markets. For 2019, approximately Php30 billion worth of residential projects across all our brands and across the country will launched.

MAXIMIZING SHAREHOLDER VALUE

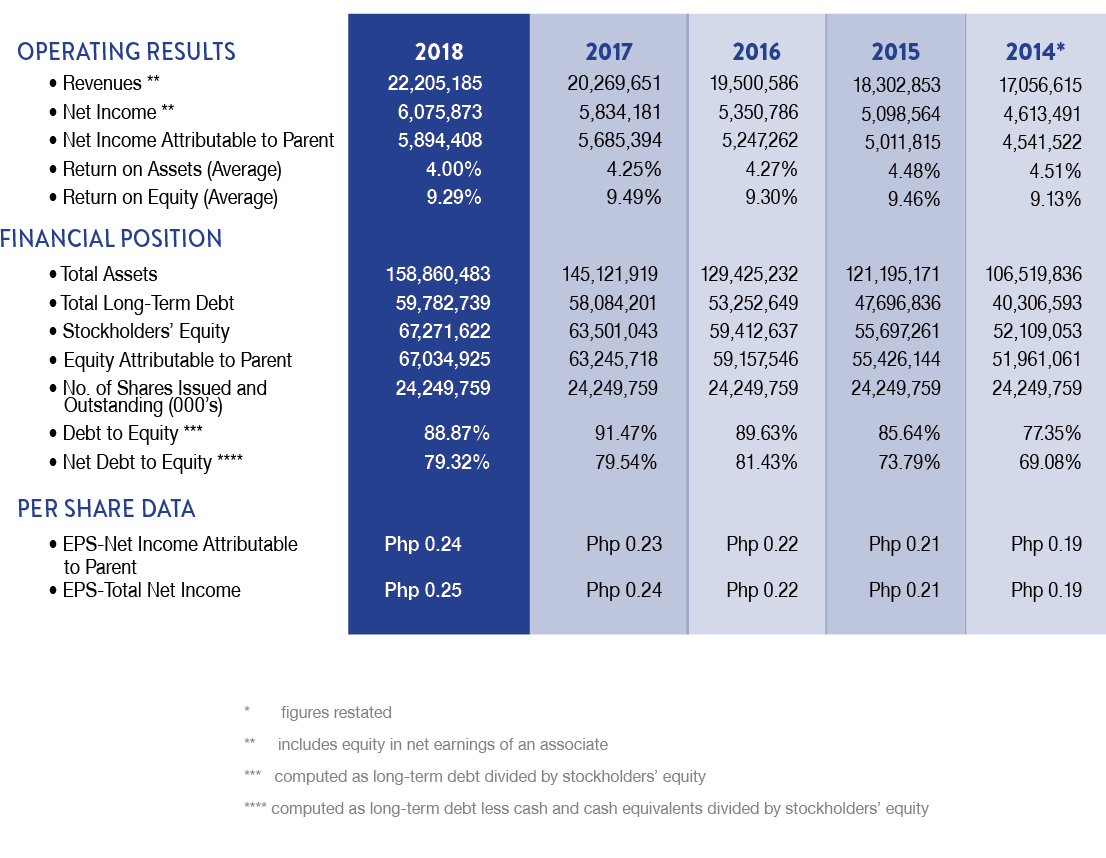

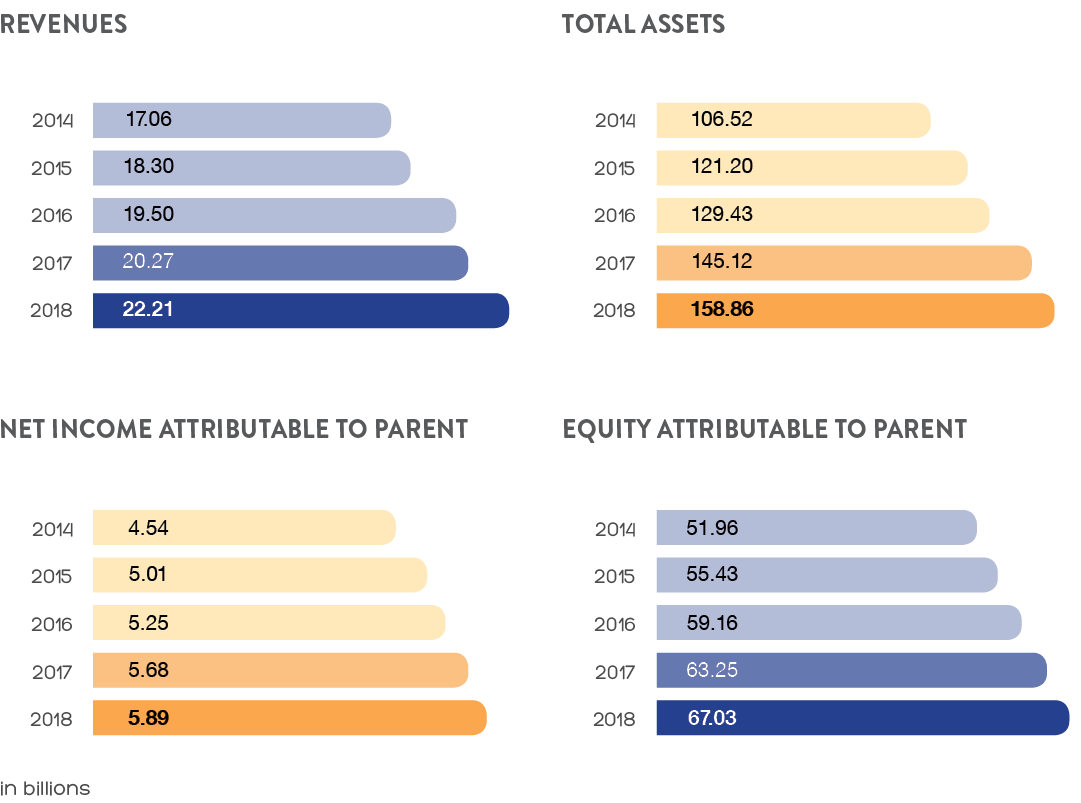

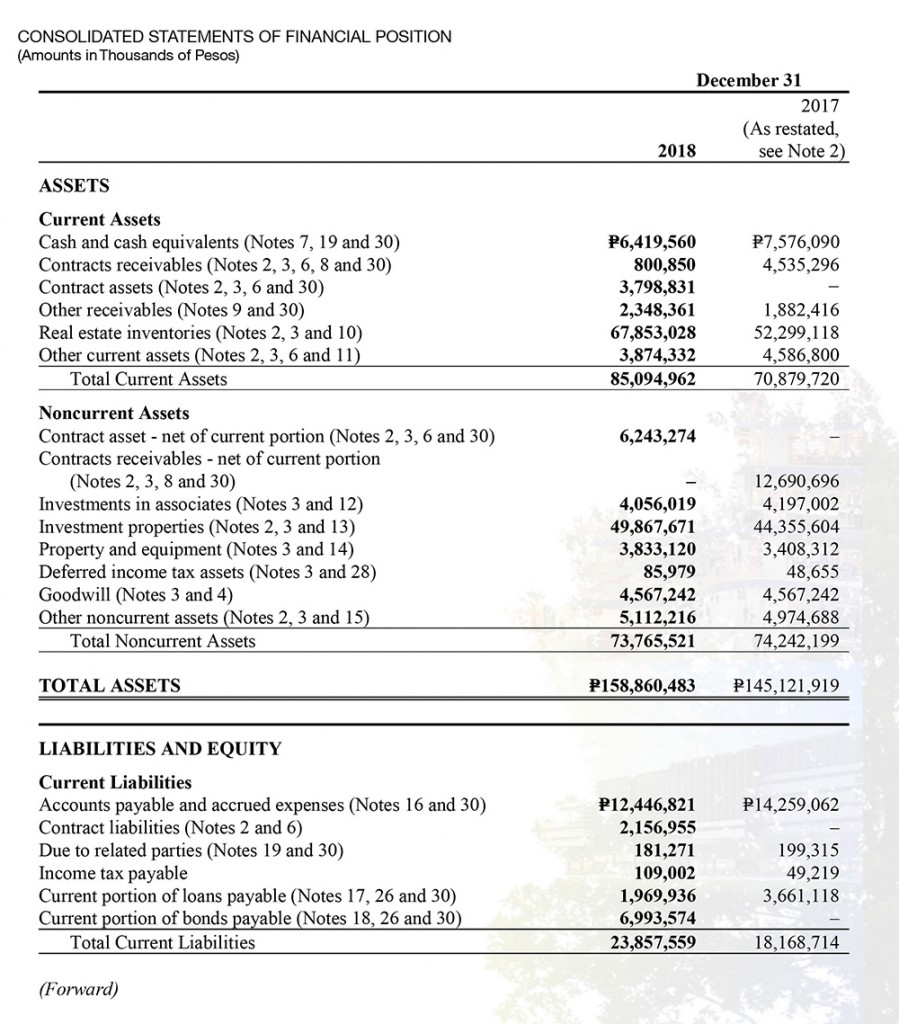

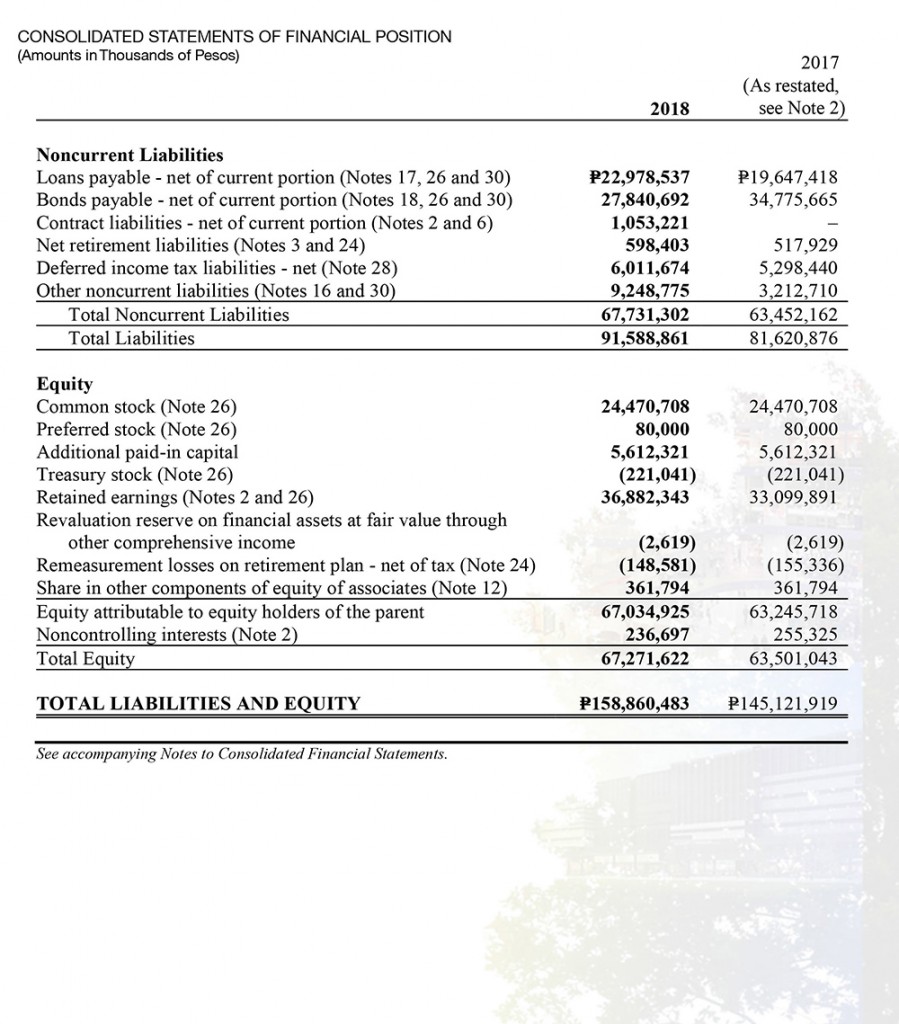

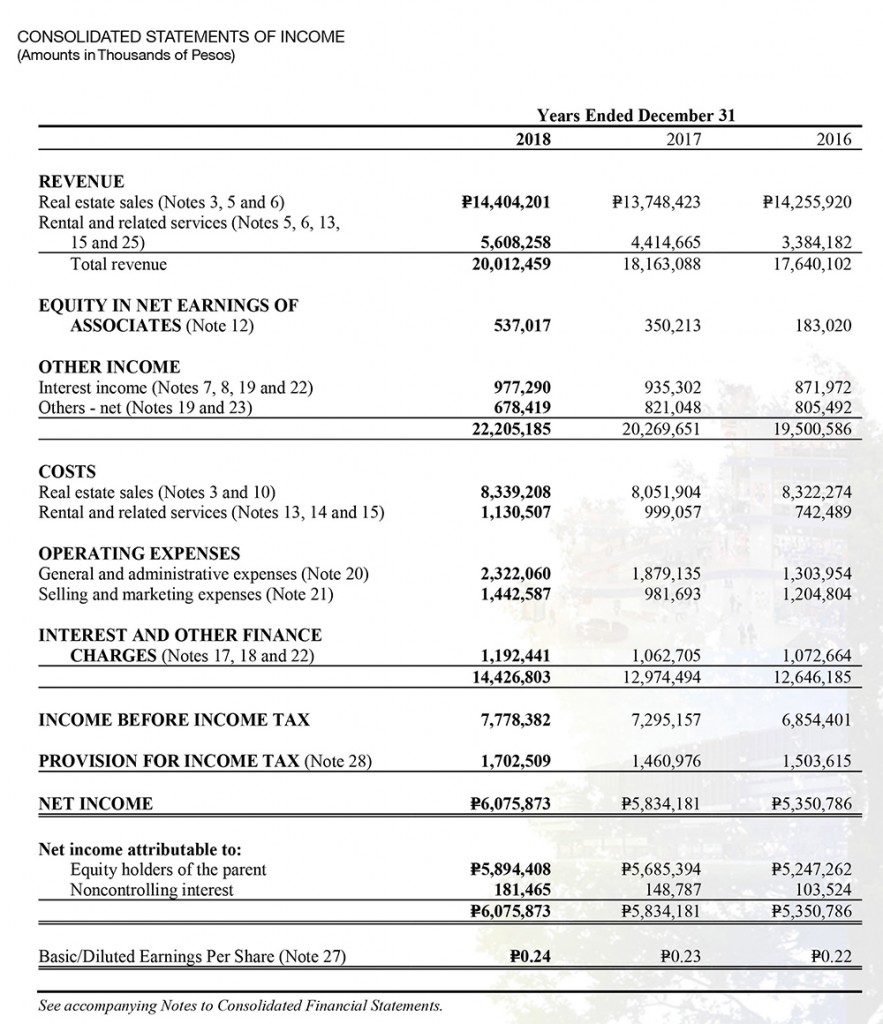

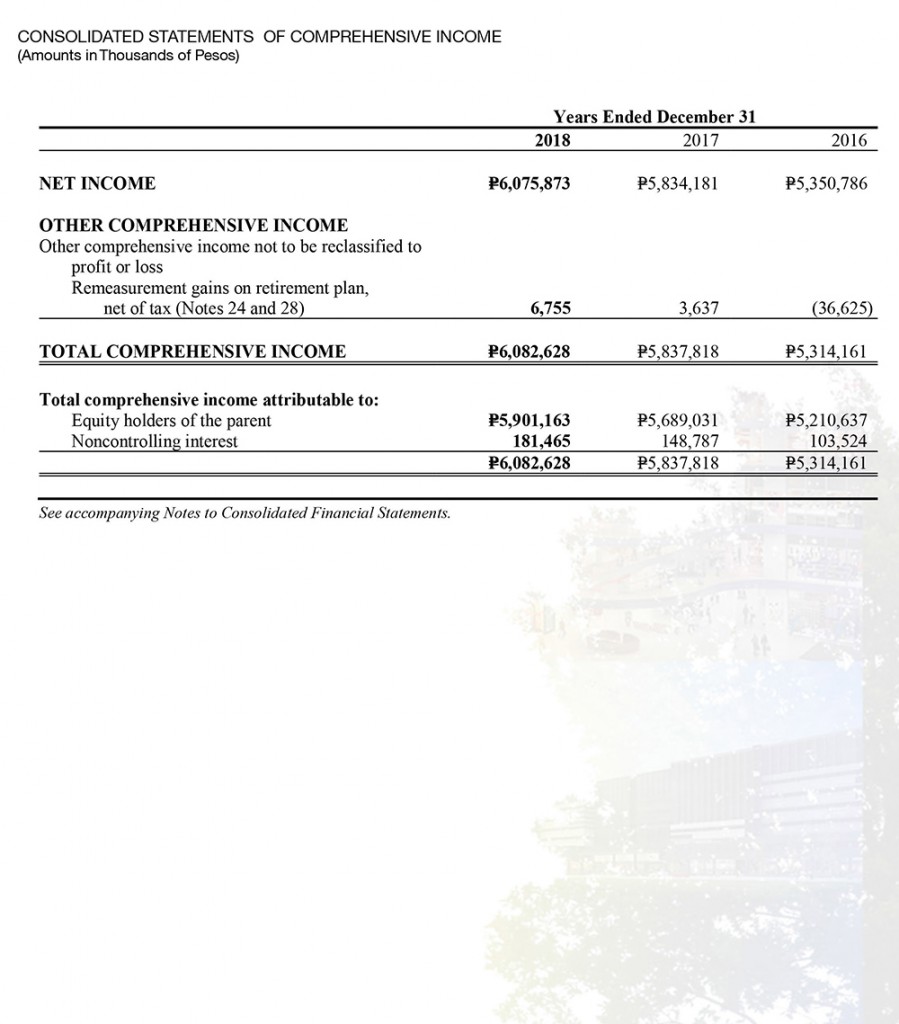

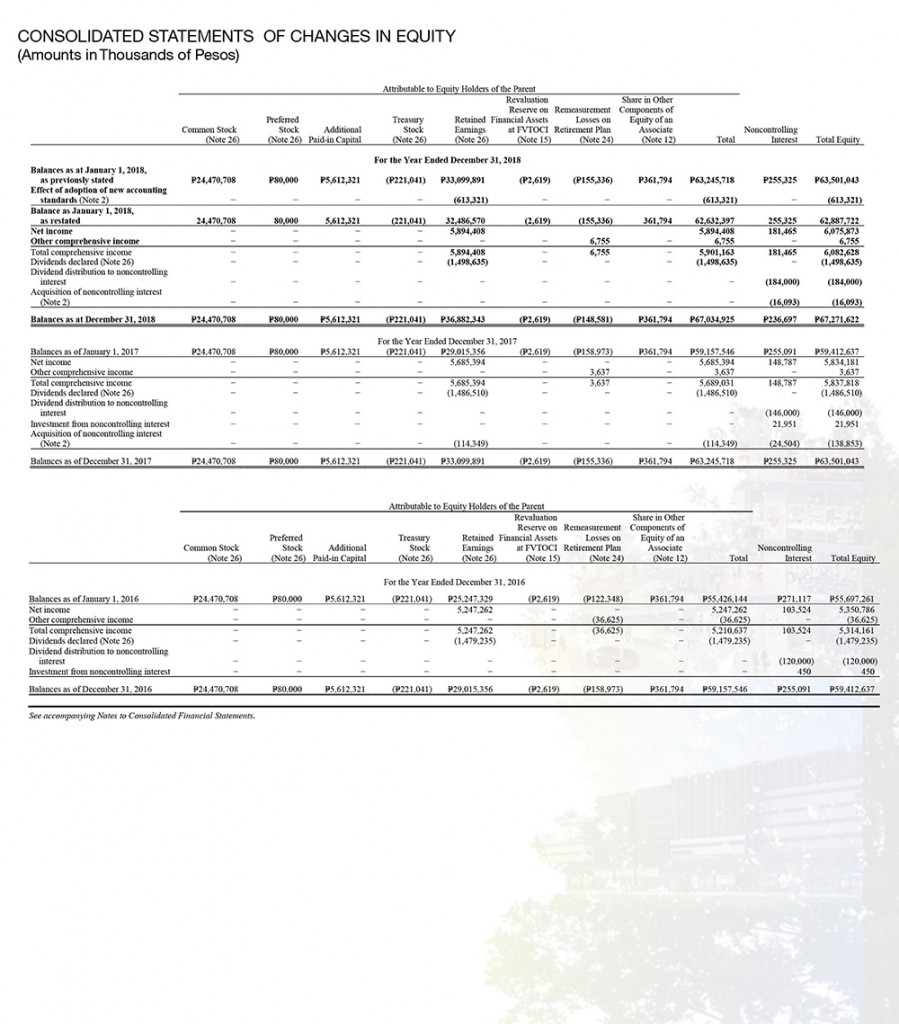

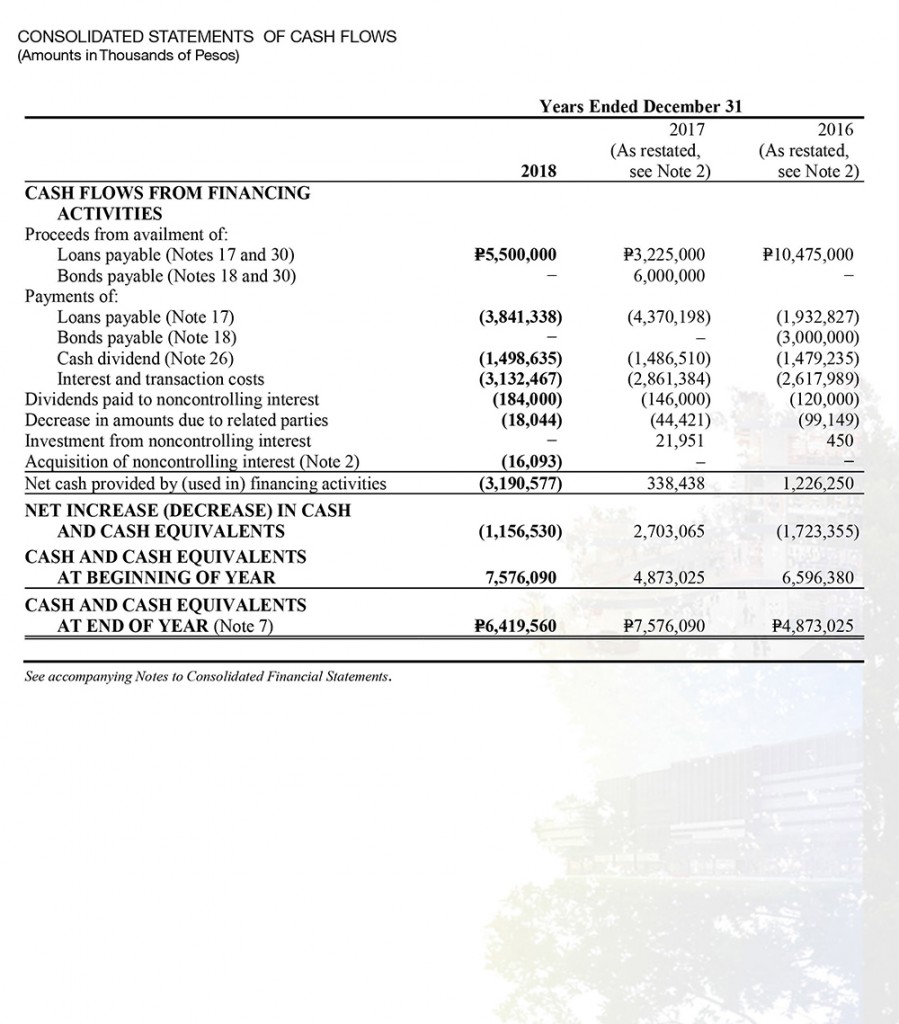

FLI ended the year with a net income of Php6.08 billion, 4% higher than in 2017 driven by the rental business.

In 2018, we declared cash dividends amounting to Php0.061 per share equivalent to 26% payout ratio and a dividend yield at the time of declaration of 3.6%, the highest among the Philippine property companies.

CORPORATE GOVERNANCE

We believe that corporate governance is about accountability, transparency and communicating to the company’s stakeholders on how the company is achieving its business plans. In 2018, your Management attended eight conferences and numerous one-on-one meetings to talk to investors and share your Company’s growth story. Your Company also conducted quarterly briefings to update the investor community of relevant corporate and industry developments. Your Company also welcomed analysts and investors in several of our developments for their appreciation of our projects.

APPRECIATION

On behalf of our Board of Directors, I would like to thank all of you, our shareholders, creditors, business partners and customers for your trust in us and giving us the opportunity to serve.