As one the largest property development firms in the Philippines - with a portfolio of more than 25 million square meters under management – we recognize our responsibility in minimizing the negative environmental impacts in the built environment through both the services we provide to our clients and our own operations. As our acquisitions, divestments, and development activity within a given year can significantly impact our environmental performance, we are committed to implementing environmentally sustainable best practices for our operations and to assist our tenants in their efforts to address their environmental concerns.

Applicable to all FLI projects, our Environmental Compliance Policy aims to provide effective environmental programs for the prevention of pollution, preservation of natural resources, and solid waste management, in compliance with relevant local and national environmental laws and regulations. Approved by our President and CEO, the policy mandates compliance to local environmental laws and regulations (such as DENR and the National Building Code of the Philippines), environmental impact planning, and measures to mitigate the potentially negative impact that a new building or community development project can create for both the pre-construction and construction/operations phases.

The Policy also mandates that with any new project, a Social Development Program shall be established to offer training and hiring of local residents, a solid waste management program, support to local institutions and schools, and to create education and communications campaigns.

We recognize that growing stakeholder demands for transparency have led to more stringent environmental reporting requirements, including the SEC ESG Guidelines. We are working to further develop and strengthen our data collection procedures and adopt a systematic approach to data collection across the Company over the next three years to enable us to better identify, disclose and manage our environmental impacts. We are also exploring strategies to address air quality, climate change, resource efficiency, and waste. We will aim to assess ESG related risks and opportunities as related to our resource and environmental management.

To our knowledge, we comply with all applicable local environmental laws and regulations. In 2019, no monetary fines, non-monetary sanctions, or disputes arose for non-compliance with environmental laws and/or regulations.

Sustainable Building Practices

In 2017 we set out to be the first to create a master-planned development in the country with a LEED version four of Neighborhood Development Plan certification. With only two other developments in the world – in Japan and Italy – bearing this coveted recognition requires meeting several criteria across several areas that address sustainability issues – among them location and transportation, sustainable sites, water efficiency, and energy and atmosphere considerations.

To meet LEED certification standards,2 our design project teams have identified several cost-effective and energy-efficient fixtures and incorporated them into focal design features in three of our commercial buildings. While some features (such as green walls and bicycle storage) are quite visible, others are less apparent to the average occupant (such as water-efficient landscaping and optimized energy performance-usage of low electric consuming lights and equipment). Altogether, each feature helps to deliver outstanding sustainable performance.

Highlights of these green building features include:

- Site Connectivity – building in high high-density areas, within a range of basic services for the immediate needs of the community.

- Green Transportation – buildings are located near public and other alternative modes of transportation for more efficient travel. They also feature bicycle storage and changing rooms to encourage occupants to limit their vehicle use and lessen the environmental impact and traffic congestion of private cars.

- Regional Building Materials – Construction materials are purchased within the vicinity of the project.

- Quality Indoor Environment – The thermal comfort of the end-users is monitored and low emitting VOC materials are used to prevent harm to occupants and the environment.

Since 2016, Filinvest has been awarded several LEED building certifications for a number of our developments:

Green Building Certification

| DEVELOPMENT |

CERTIFICATION AWARDED |

| Axis Tower One |

LEEDv3 Gold for Core and Shell – 2017 |

| Axis Tower Two |

LEEDv3 Gold for Core and Shell - 2018 |

| Cyberzone Bay City Phase 1 |

LEEDv3 Silver for Core and Shell - 2017 |

| Cyberzone Bay City Phase 2 |

LEEDv3 Silver for Core and Shell - 2019 |

Green Building Pre-Certifications

| DEVELOPMENT |

CERTIFICATION AWARDED |

| Axis Tower Four |

LEEDv3 for Core and Shell - In progress |

| Axis Tower Three |

LEEDv3 for Core and Shell - In progress |

| Activa - Mixed Use |

LEEDv3 Gold for Core and Shell – In progress |

| Studio 7 |

LEEDv3 for Core and Shell - In progress |

| IT Park - Building 1 |

LEEDv3 Gold for Core and Shell – In progress |

| IT Park - Building 2 |

LEEDv3 for Core and Shell - In progress |

| One Filinvest |

LEEDv3 for Core and Shell - In progress |

| 2LEED® stands for Leadership in Energy & Environmental Design, which is an internationally recognized green building standard established by the United States Green Building Council. Official website: www.usgbc.org/leed |

Resource Management

Our approach to measuring and monitoring how we manage resources starts with projects adhering to our Environmental Compliance Policy and continues throughout the lifecycle of the construction and operations phases.

Ecosystems and Biodiversity

Our Environmental Compliance Policy outlines proper preservation methods, such as ensuring that all existing endemic wildlife species in a development area shall be protected by FLI, including their habitats. It also includes a clause that an Environmental Guarantee Fund shall be set up for every FLI project for rehabilitation and restoration activities of affected areas, as well as stipulating compensation of damages and assistance to affected parties should irreparable damages occur.

We have also set as a rule that for every tree cut for a development project, it shall be replaced for continuous greenery maintenance.

Energy and Air Emissions

We recognize our capacity to enhance the energy efficiency of our projects while reducing our carbon emissions. Beyond our green building efforts, we continually seek ways to optimize building performance and reduce energy usage and emissions.

Within our operations, as mandated in our Environmental Compliance Policy, during the construction phase all emissions are to confirm with the emissions standards of DAO 14 (Revised Air Quality Standards of 1992). Any dust emissions are controlled with periodic watering of roads during the dry season and dump trucks used in the delivery and transport of filling materials are covered.

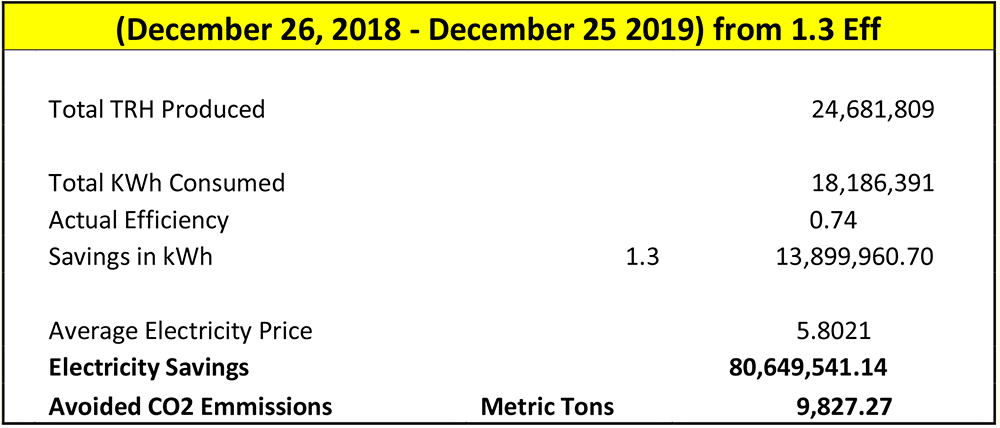

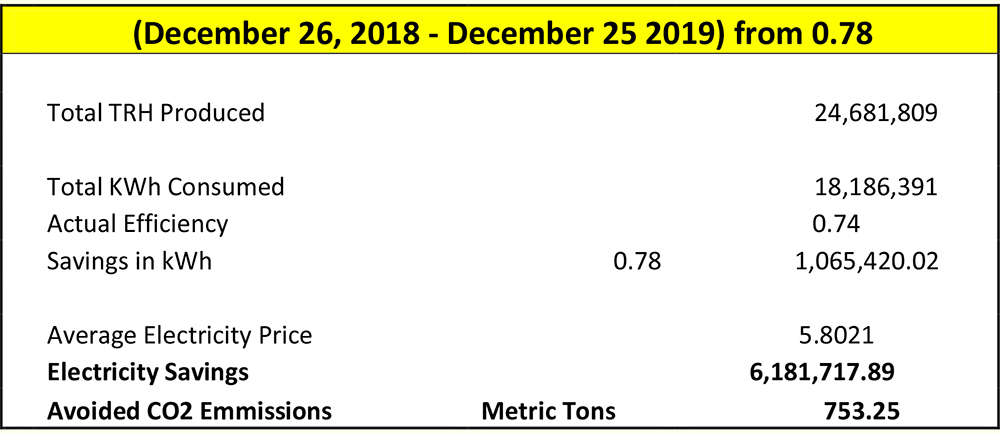

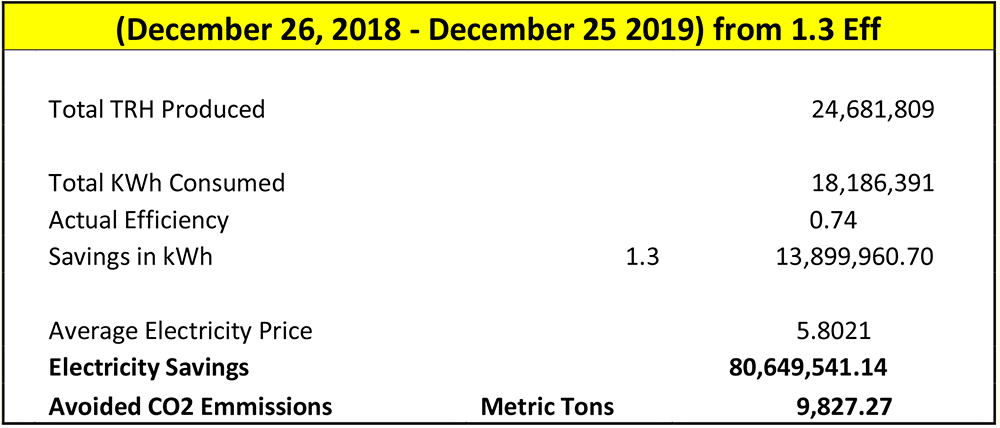

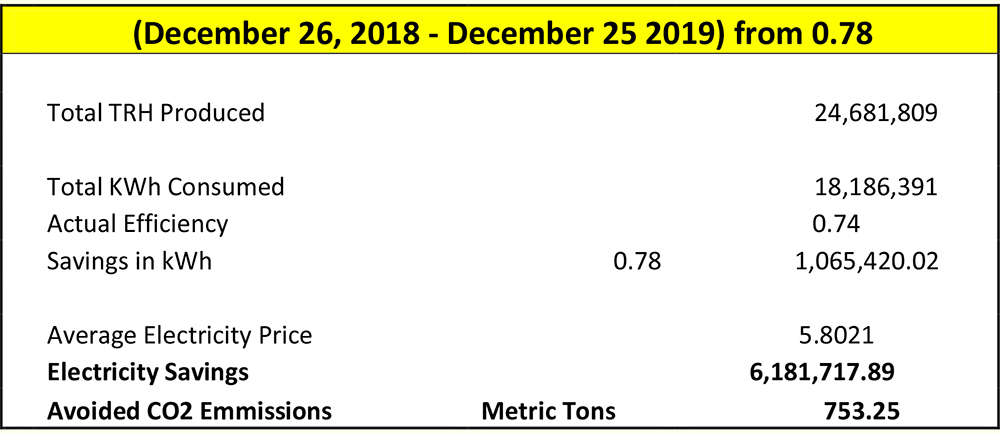

Spotlight: PDDC’s Innovative District Cooling Systems

Keeping the Northgate Cyberzone cool

In 2017, FLI’s Philippine DCS Development Corporation (PDDC) partnered with Engie Services Philippines* on a joint venture to develop the Philippines’ largest district cooling system in Northgate Cyberzone in Filinvest City. The 10,000-ton centralized DCS plant has a cooling capacity of 42.2 Megawatts that caters to 15 buildings through a 3.4km underground distribution network of steel pipes with a span of 20 years. The system provides numerous benefits including:

- Lower building structural requirements

- Noise reduction

- Reduction of CO2 emissions and polluting waste (i.e. refrigerant leakage)

- Reduction of electricity consumption of at least 30% - 40% of plant consumption

- Reduction of water consumption

- Smaller electrical system and backup generators

- Reduction of operations and maintenance costs in terms of:

-

- No chemical usage for cooling towers

- Spare parts and consumables

- Periodic and unscheduled major maintenance

- Engineering Services

- Manpower cost related to Chilled Water operations

- Management oversight

The Northgate Cyberzone District Cooling System has put the Philippines on the global map alongside the world’s key players in District Cooling System, such as ENGIE’s Climespace in Paris, France, and the Megajana in Cyberjaya, Malaysia.

Boosting PBCom Tower’s Energy Efficiency

In 2019 PDDC also partnered with Engie Services Philippines* on a joint venture to provide a chilled water plant within the 52-story PBCom Tower through the Build-Own-Operate-Transfer (BOOT) model, where PDDC will design, finance, rehabilitate, construct, install, operate and maintain a new and efficient chilled water plant that will provide energy savings to the tower. State-of-the-art technology will cut energy consumption in the Philippines’ third tallest building by about 4,103 MWh per year (equivalent to 2,429 eq. tons of CO2 emissions). The project also aims to cut carbon dioxide emissions, a key component of FAC’s vision of sustainable development.

*PDDC is an incorporated joint venture between FLI and Engie Services (Philippines), the local arm of the France-based Engie, a global leader in Energy Efficiency and Environmental Services. The joint venture is part of Filinvest’s efforts to develop environmentally-sustainable communities and to show support for the Philippine Government’s drive for green energy. It is also the collaborative response of Filinvest and Engie to the co-create mitigating measures that address climate change-related concerns.

Water

Water is a key component of the construction and operations of any project. As such, we are committed to ensuring that we manage water and wastewater as responsibly as we can. In 2019, we consumed 5,132,064 cubic meters of water and discharged 4,517,545 cubic meters. We recycled 1.16% of our total wastewater.

Our Environmental Compliance Policy mandates proper drainage systems be installed during pre-construction, for the proper collection and disposal of storm run-off. We also use a combination of open and closed drainage systems when building in smaller land areas and we install a sewerage system and/or a sewerage treatment plant to treat domestic discharges, in compliance with discharge standards set by the DENR.

During the construction and operations phase, we ensure that housing units and other amenities are not built along active natural waterways and no construction or development is undertaken immediately next to rivers or streams in efforts to avoid erosion and unintended siltation of water bodies. Any temporary ditches or canals are lined with silt raps to minimize sedimentation/siltation of nearby tributary rivers and are removed after construction is completed. Also, all deep well water supply is subject to primary water treatment and any effluent discharges must meet the Effluents Standards under DAO 35 (Revised Effluent Regulations of 1990) and DAO 34 (Revised Water Quality Criteria).

Thinking beyond our own development projects, we consistently seek to create environmentally-friendly infrastructure and support local community investment initiatives when we can. For example, Filinvest City was the first township in the Philippines to register for LEED v4 for Neighborhood Development Plan and is currently in the initial phases of completing its certification requirements. The Group has also constructed a sewage plant and water recycling facility within Filinvest City to allow the use of greywater for irrigation. Also, our Northgate Cyberzone development houses the country’s largest district cooling system that can reduce energy consumption for chilled water supply by up to 40%.

Spotlight: Utilizing Desalination Technology and Providing Water Services

The Group, through its wholly-owned subsidiary, Countrywide Water Services, Inc. (CWSI), has been utilizing desalination technology for several years to provide much-needed water at competitive rates to hotels and residential projects that are owned by the Group as well as by external entities. The Group is also exploring potential partnerships with major industry players to tap into the latest developments in desalination technology to further improve the efficiency of this cutting-edge technology. CWSI provides water and wastewater services to its affiliates in the property business such as Filinvest City in Alabang and the Filinvest Mimosa+ Leisure City in Clark, Pampanga and Filinvest Land residential projects. CWSI’s water services include the supply and distribution of potable water to domestic, commercial, and industrial consumers while its wastewater services include the treatment of domestic and commercial sewage.

Materials

In 2019, our projects required the use of 29,773 tonnes of rebar, and 137,860 tonnes of cement.

Waste

Most of the waste directly generated by our business comes from the construction of our development projects. Our Environmental Compliance Policy outlines that all solid waste be properly collected and disposed of in designated disposal sites in accordance with the project site’s Solid Waste Management Plan.

Also, the proper handling, collection, and disposal of toxic and/or hazardous substances are fulfilled in accordance with the provisions of RA 6969 (Toxic Substances and Hazardous and Nuclear Waste Control Act of 1990) and that proper permits are secured from DENR accordingly.

In 2019, 158,481 tonnes of office and construction waste was sent to landfill.