2021 Annual Report Filinvest Land Inc

Accelerated transformation towards sustainable communities

Filinvest Land seizes every opportunity to help build the Filipino dream. The challenges it faced during the pandemic became opportunities to fast-track its plans and create greener possibilities to go beyond survival, continuously design and build thriving communities for generations, helping shape the country’s future.

VISION

To be the most trusted placemaker of environs tha inspire and enhance a happy life

MISSION

- To enliven and enrich lives in Filinvest communities

- To enable and encourage the growth of our partners

- To create and add value for our investors

- To build platforms that create vibrant and sustainable ecosystems

- To respect and protect the environment

- To keep affordable housing at our core

CORE VALUES

The core values of integrity, customer service, professionalism, teamwork, innovation, and cost-effectiveness are highly valued. The highest standards of business and moral ethics shall be exercised.

2021 in Review: Recovery of the Residential Business

On our second year of the pandemic, your company has put in place a dynamic business model that enabled it to operate efficiently.

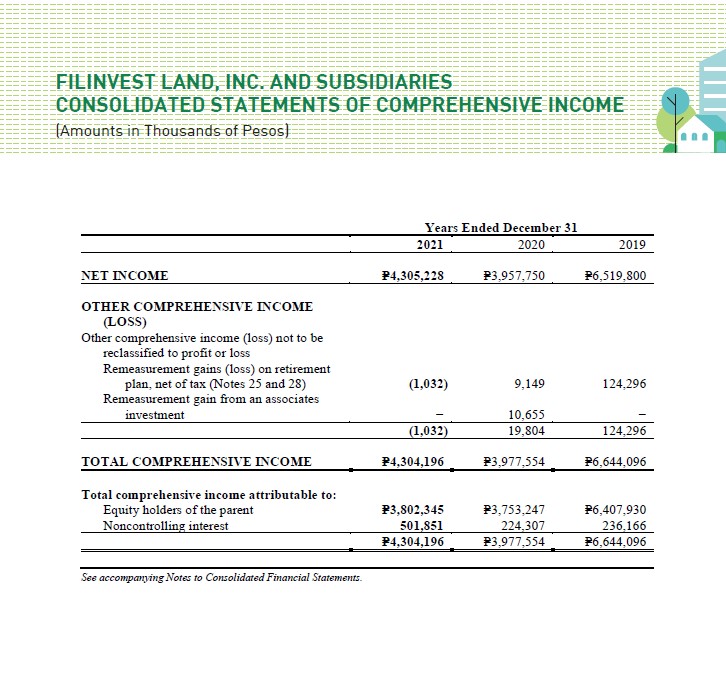

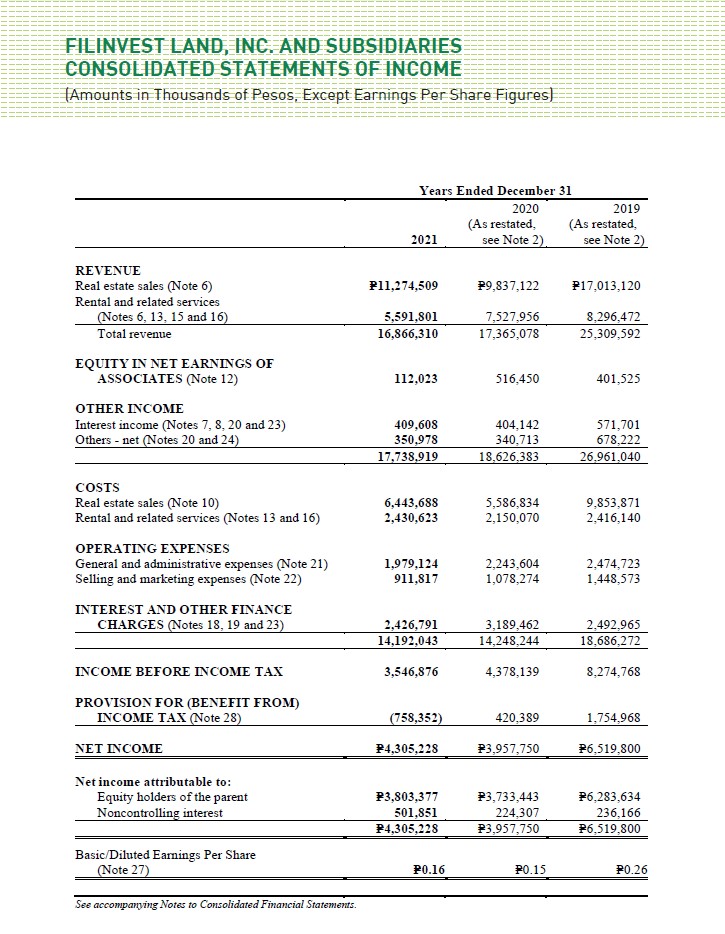

In 2021, we saw an improvement in the residential business. Residential revenues increased 14.6% to P11.27 billion, while reservation sales rose 5% to P16.04 billion after 2 years of decline. We believe that this signals the recovery of the residential business as buyers are more confident of a better economy and business environment.

Our homebuyers are attracted to our developments which are built to be sustainable communities. We ensure that our residential developments are environment-friendly, safe and have the residents’ well-being in mind. Our residential revenues increased due to the easing of construction restrictions that resulted to higher progress and completion of projects. We are hopeful that the trajectory of growth for the residential business will continue beyond 2022.

Continued concessions in support of our mall tenants coupled with the full year impact of 2020 pre-terminations of POGO office tenants outside of the Filinvest REIT (FILRT) portfolio caused a 26% decline in rental revenues. We believe that this would be the trough of the rental business cycle.

2021 is also the year that the CREATE bill was implemented, which provided among other things, the reduction of income tax rate to 25% from 30%. The foregoing resulted to a Net income attributable to equity holders of P3.80 billion which increased 2%, a respectable performance despite the challenges.

In 2021, FILRT became part of the Morgan Stanley Capital International (MSCI) Philippines Small Cap Index and FLI followed in 2022 to be part of the PSE MidCap Index.

Dreams Built Green

True to our reason for being, that is Building the Filipino Dream, FLI has successfully launched residential projects that are modelled as sustainable communities characterized by large and green open spaces. We design homes with energy efficiency in mind as we ensure ventilation and natural light. Our focus on affordable and middle-income segments makes our developments inclusive as we offer affordable and value-for-money quality homes.

We have a diversified residential portfolio – both geographically and product wise that makes our homes appealing to a wide market. Our emphasis on landed housing worked to our advantage as homeowners shifted to this in the light of the pandemic. Having a faster cashflow turnaround and being less prone to construction risk also make landed housing more affordable.

Transforming into an Investment Management Company

The year 2021 marked an important milestone for FLI. On August 12, 2021, the Filinvest REIT Corp. (FILRT) was listed on the Philippine Stock Exchange, as the third REIT (Real Estate Investment Trust) in the country. FLI sold 36.7% of its ownership in FILRT (formerly Cyberzone Properties Inc.) to the public. This marks the transition of FLI from a development focused company into an investment management company.

FILRT’s successful IPO (Initial Public Offering) generated net proceeds of P12.26 billion. FILRT is composed of seventeen (17) buildings mostly located in Northgate Cyberzone, a PEZA-accredited IT park in Filinvest City, Alabang, Muntinlupa. FILRT is the first sustainability focused REIT. These buildings have the unique advantage of being located within Filinvest City, the first LEED-certified CBD in the Philippines and the largest in Southeast Asia that has attained LEED Gold in Sustainable Neighborhood Development. Substantially all of this office portfolio is serviced by the country’s first and largest district cooling plant with a 12,000 ton capacity. Built in 2017, the district cooling system protects the environment by cutting carbon dioxide emission through lower energy consumption, making it a key component of sustainable development.

We look at this IPO as an opportunity to accelerate growth as your company reinvests the proceeds in investment property and residential developments across the country.

The REIT issuance also provided the opportunity to recognize the real value of our office assets. The initial portfolio is valued at P48 billion by a third-party property appraiser while the book value of such assets was P10 billion at the time of appraisal.

In 2021, FILRT generated P3.44 billion in revenues and P1.85 billion in net income. FILRT has distributed three quarterly cash dividends to date totaling P0.336 per share. This is equivalent to an annualized dividend yield of 6.4 percent based on its initial public offering (IPO) price of P7.00 per share. This is higher than benchmark rates and better than the 6.3 percent dividend yield it projected for 2021 in its REIT Plan. To date, FLI has received P1.09 billion in dividends from FILRT.

Including FILRT assets, FLI and its subsidiaries operate 36 office and retail developments with over 780,000 square meters of Gross Leasable Area (GLA). Our investment properties also include warehouse and land lease spaces for the logistic and e-commerce players and co-living accommodations. Your company targets to reach 2.1 million square meters GLA by 2026 of investment properties. Your company’s presence in three major BPO Hubs – Metro Manila/Alabang, Clark and Cebu and its extensive land bank allows it to produce 5.3 million square meters of GLA. Our vast inventory of investment properties are potential infusions to grow FILRT, which will provide opportunities for FLI to further recycle its capital.

"Our vast inventory of investment properties are potential infusions to grow FILRT, which will provide opportunities for FLI to further recycle its capital."

Managing the Pandemic

We continued to manage our cash flow conservatively by launching a modest number of projects during the year as we continuously evaluated inventory absorption and potential cancellations due to pandemic job impact. We have, however, a pipeline of P30 Billion that are ready for launch once market demand dictates.

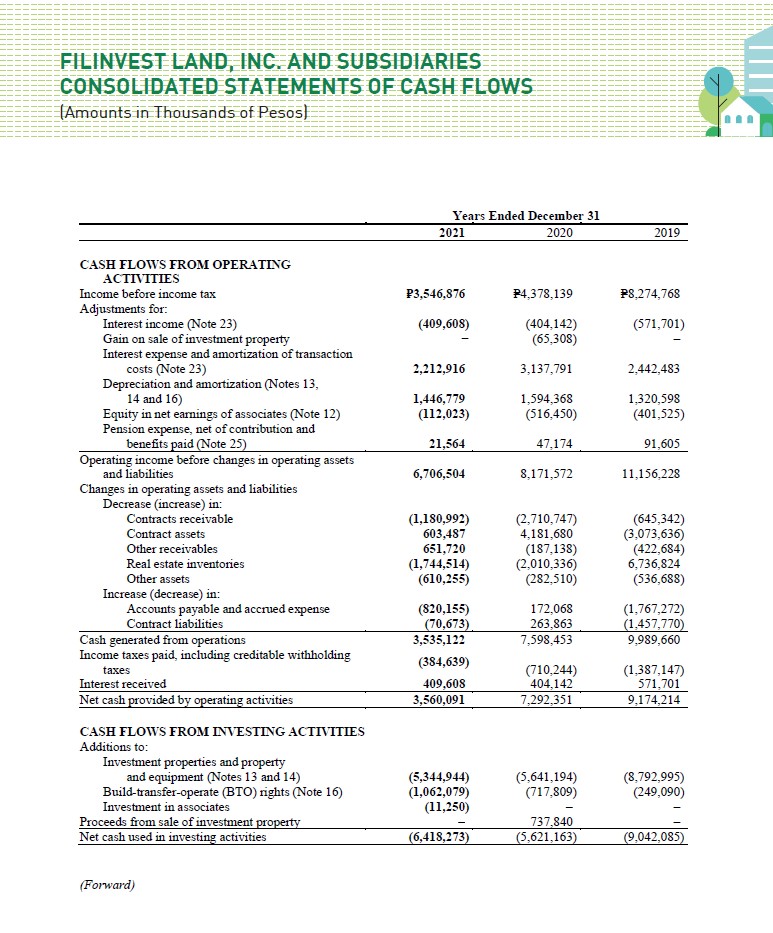

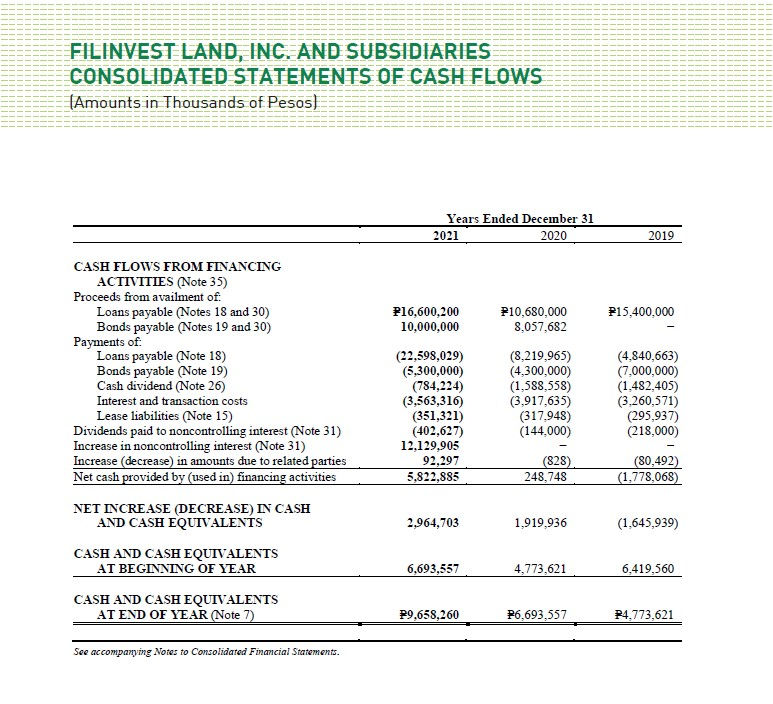

Leverage was down from a net debt to equity (DE) ratio to 0.66 to 1 and gross DE ratio of 0.76 to 1 from 2020 levels of 0.85 to 1 and 0.94 to 1 respectively.

FLI also raised P10 billion through the issuance of 4- and 6- year peso fixed-rate bonds in December 2021. The bonds, which attained the highest PRS Aaa rating from the Philippines Rating Services Corporation (PhilRatings), was four times oversubscribed. We are grateful for the trust of the investor market in Filinvest Land. This was instrumental to our successful fundraising activities in the past year. These funds will accelerate the implementation of our expansion plans and continue building the Filipino dream.

The interdepartmental synergy teams we formed right before the first lockdown formulated solutions, process improvements and digitalization of key data that helped us navigate through the two years of the pandemic. Our digitalization efforts bore fruit as we were able to continue our sales efforts and capture the increasing demand for sustainable homes. Our customer management system ensures that transactions are processed in a timely manner.

Prospects for 2022

In the last quarter of 2021, during the aftermath of the disruptive Delta Variant, we saw a glimpse of an opening economy amidst a widely vaccinated Greater Metro Manila population. The year 2022 opened with an extreme surge but short Omicron assault which caused a pause to the economy but it quickly resumed its upward momentum. GDP grew by 7.8% in the last quarter and is projected to grow by 7-9% in 2022. As we anticipate the reopening of the economy, our balanced portfolio of residential inventory and investment properties will be ready to meet the demands of the market.

As we look forward to the new normal and a brighter future, we are confident that a renewed business environment will enable us to serve more homebuyers, office and mall tenants. We are excited about our new businesses, the industrial parks and co-living accommodations.

Allow me to thank you again, our home buyers, office and retail tenants, for your continued trust. Be assured that we are committed to serving you in the best way possible.

I would also like to express my appreciation to our different stakeholders: our business partners, creditors, and shareholders for your continued support in our commitment to customer excellence.

To my management team and the Filinvest family, you have been my greatest partners in this journey with your dedication, loyalty, sacrifices and hard work, my sincerest gratitude. Together we will continue to build the Filipino dream.

Finally, to our Board of Directors, we thank you for your steadfast guidance and wisdom.

"As we look forward to the new normal and a brighter future, we are confident that a renewed business environment will enable us to serve more homebuyers, office and mall tenants."

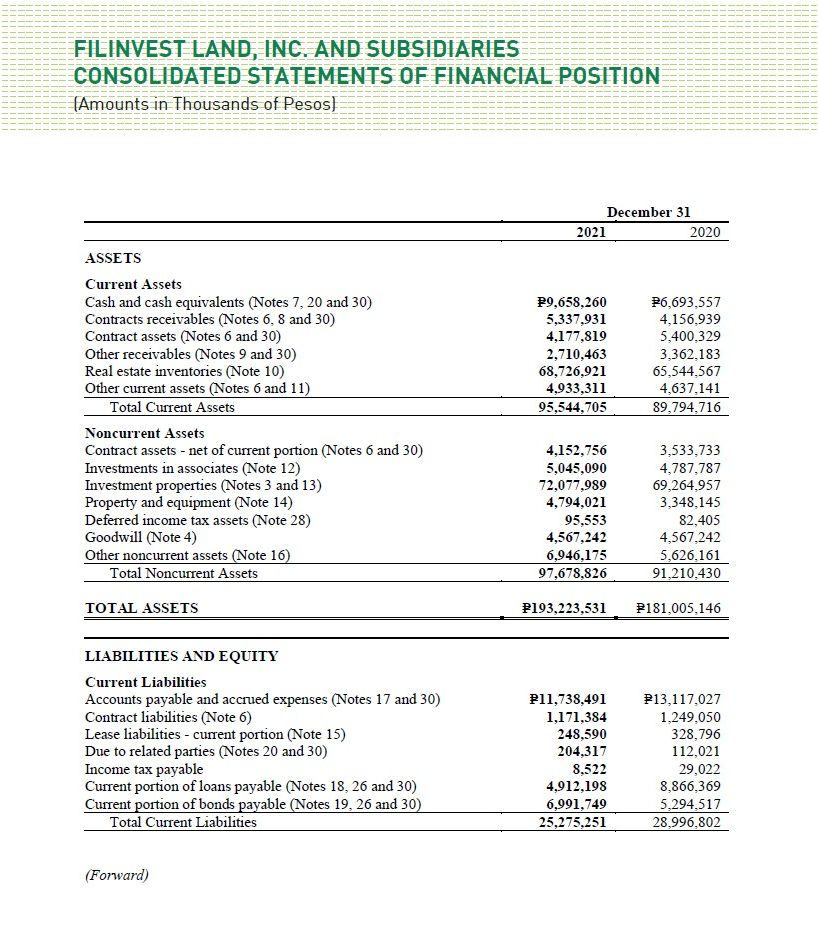

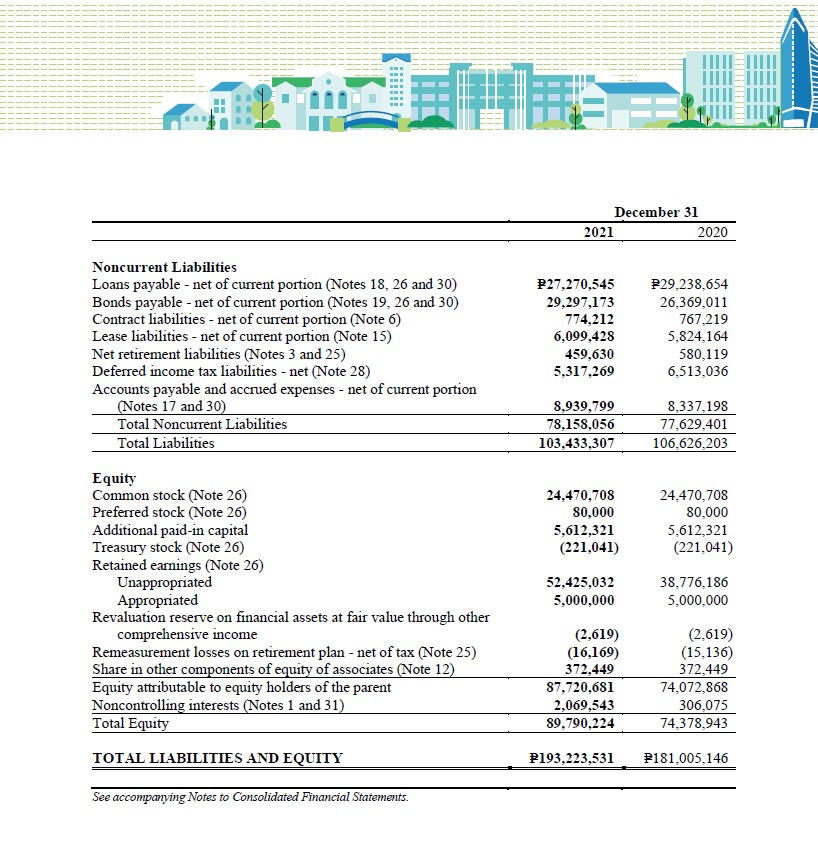

2021-Financial-Highlights

We have faith that the affordable and middle-income

residential sales will continue to be strong

and will drive your Company’s profitability.

2021-Financial-Highlights-Graph

2021: On the Way to Recovery

In 2021, on our second year of the pandemic, the business environment remained challenging but we remained steadfast as we ensured continued business operations and prepared for recovery. With the company's Business Continuity Plan in place, FLI was able to implement processes on health and safety, cash flow management, customer management, construction protocols and supplier payments. Your company became a digital entity as it maximized its digital resources and ensured efficient operations.

We are hopeful that signs of recovery will be sustained. The Philippine economy grew 5.7% signaling a recovery from the effects of the COVID19 pandemic. Likewise, OFW remittances improved by 5.1% reaching USD34.88 billion which reflected on our reservation sales. Our sales from OFWs grew 7% in 2021 accounting for 22% of our total reservation sales. Fortunately, interest rates remained stable as a result of the government’s accommodative monetary policy which still made housing affordable. All these contributed to the modest growth of reservation sales in 2021. OFW remittances and interest rates are also drivers of consumption spending which we expect to improve, and consequently our retail mall business. We are optimistic that the trend for OFW remittances and interest rates will continue in 2022 and the succeeding years.

Our focus on the affordable and middle income markets, the end-user and underserved markets helped us generate sales in the 2021. We expect this to continue in 2022 and the succeeding years. We have faith that the affordable and middle income residential sales business will continue to be strong and will drive the company’s profitability.

Recently signed into law is RA11595 Amendment of The Retail Liberalization Act which aims to ease the entry requirements by foreign retail companies into the Philippines and at the same time encouraging these companies to sell Philippine-made products. This will bode well for our retail mall business as we expect more foreign retailers to invest in the Philippines.

The BPO sector continues to be a major driver of the office leasing business. We have faith that the Philippines will continue to be the preferred location of multinational BPOs with our highly educated manpower pool and relatively lower labor costs. The sector is expected to grow by 7-8% in the next two years. With the directive by the Fiscal Incentive Review Board (FIRB) under the Philippine Department of Finance for BPO employees to return to site (from work from home arrangements), we expect the office leasing business to continue to grow in 2022.

"With the company’s Business Continuity Plan in place, your company became a digital entity as it maximized its digital resources and ensured efficient operations.”

"We also ensure inclusivity as we provide homes to all customer income groups including the socialized and affordable income segments."

Towards Sustainable Communities

Last year, we started preparing our 2030 Sustainability Road Map. Based on the UN Sustainable Goal “ Making Cities and Human Settlements Inclusive, Safe, Resilient and Sustainable”, our priority is to be able to ensure the right environment for homes keeping in mind the future generations. We strive to understand the needs of our residents as we design and build high quality and sustainable homes. During the pandemic, we have seen homebuyers search for their ideal homes in safe and sustainable environments amidst nature and open spaces. We also ensure inclusivity as we provide homes to all customer income groups including the socialized and affordable income segments.

Recognition

We are proud to be recognized by BCI Asia as one of the Top 10 Developers in the country while Dot Property hailed the company as the Best Developer in North Luzon and Mindanao. Josephine Gotianun Yap, President and CEO of Filinvest Land, was Asia CEO’s Global Executive of the Year Circle of Excellence awardee.

Maximizing Shareholder Value

We are committed to maximizing shareholder value. Despite the uncertainties during the year, the company declared dividends equivalent to 20% of 2020 income or a total of P747 million, in line with our dividend policy. This is equivalent to a dividend yield of 3%, a modest rate given the uncertainties.

On March 28, 2022, FLI shares were included in the newly launched PSE MidCap Index. We view this as a positive development as FLI shares will become more visible to potential investors.

Appreciation

On behalf of our Board of Directors, I would like to express my appreciation to all of you, our shareholders, creditors, business partners, employees and customers for your continued support and faith in us.

2021 in Review

We are pleased to report that our residential business performed well in 2021 despite the continuing challenges brought by the pandemic. Revenues from the residential business increased by 15% to P11 billion due to construction progress and higher reservation sales.

Reservation sales grew by 5% to P16 billion, driven by OFW sales which rose 7% and accounted for 22% of total sales, as more countries opened and OFW deployment improved. We believe that the improvement in OFW sales signals the recovery, and hopefully, return of the large OFW market, which is a critical driver in real estate sales.

We have a diverse product portfolio, and our balanced offering provided our buyers an answer to their shift in living preferences brought about by the pandemic. We noticed a considerable increase in House and Lot sales, accounting for 53% of our residential reservation sales. This evidence confirms a new buyer preference for lower-density developments that offer broader and more open space.

Our residential business is as much present in Visayas, Mindanao, and the rest of Luzon as we are in Metro Manila. And our geographic diversification allowed us to generate consistent sales and revenues as more regional cities outside Metro Manila recovered and opened earlier. Our residential projects in Non-Metro Manila accounted for 66% of total sales, while Metro Manila or NCR projects contributed 34% of our 2021 sales.

Aside from Metro Manila, Laguna, Cavite, Rizal, Davao and Cebu which are likely business locations of major real estate developments, we are also present in Koronadal and General Santos City in South Cotabato, Zamboanga City, Samal Island in Davao Del Norte, Talisay City and Dumaguete City in Negros, Dagupan City in Pangasinan, and Puerto Princesa in Palawan. At the end of 2021, our residential business was present in 22 provinces and 55 towns and cities.

FLI has exhibited solid sales and revenue performances for Housing and Medium-rise Buildings or MRB condos. To this end, FLI will remain focused on further strengthening this core, particularly housing and MRB condo units targeting the affordable and middle-income segments of the market.

We launched Claremont Phase 5, an expansion subdivision of our 20-hectare Claremont project, helping the hardworking Filipino attain his dream of owning a home in Mabalacat, Pampanga. We also opened additional condo buildings in our Futura Centro project in Sta. Mesa, Manila, Alta Spatial in Valenzuela City, and launched our first condo building in Futura One at Fora Dagupan, our first estate development in North Luzon.

Futura One is Dagupan’s first master-planned condo community within the dynamic business hub of Fora Dagupan. It offers mid-rise buildings with internet-ready condo units, green open spaces, relaxing amenities, and 24/7 security.

The Futura brand targets the affordable market segment while the Aspire brand is for urban professionals and upwardly-mobile families in the middle-income and upper-middle-income market segments.

"We have a diverse product portfolio, and our balanced offering provided our buyers an answer to their shift in living preferences brought about by the pandemic."

Land Development for Housing Subdivisions completed

- New Leaf (Trece Martires, Cavite)

- Claremont Phase 4 (Mabalacant, Pampanga)

- Aria at Serra Monte (Cainta, Rizal)

- Mira Valley (Antipolo, Rizal)

- Maui Oasis Kahana

- One Spatial Ilo-ilo Building 1

- Marina Spatial Building C

- 8 Spatial Building 5

- Bali 2 Kendal

In addition to the above-cited projects, there are currently 2 MRBs and 8 more housing projects undergoing land development plus 21 MRBs with ongoing construction works.

- Futura Homes Koronadal

- Futura Homes Zamboanga

- Alto at Fileast

- The Tropics 4

- Southwind

- Rosewood

- Alta Vida Phase 4 and Phase 5

- Sandia Homes Phase 2

- Panglao Cabana

- Alto @ Fileast

- Claremont Ph5

- Asiana Chi

- Veranda 8

- Alta Spatial –Cedar

- One Oasis CDO Bldg 4

- Futura Dagupan

- Futura Centro B

In 2021, we launched Alto at FilEast, a horizontal development inside Filinvest Homes East which is now sold out. We added new mid-rise condo buildings in Panglao Oasis in Taguig City, Asiana Oasis in Paranaque City, both in Metro Manila, and One Oasis Cagayan De Oro in Cagayan De Oro City and Veranda in Samal Island, both in Mindanao.

We are continuously looking for opportunities to launch new projects to protect our market share in areas where we already have a business presence and to respond to unserved demands in emerging growth areas. In 2021, we launched a total of P6.7 billion worth of new housing and condominium projects all over the country.

We are also ready to roll out more new projects in 2022 as we have already prepared complete plans and geared up our product delivery capacity to support further launches in the years ahead. The pandemic years gave us plenty of time to prepare, get our rollouts ready, and allow us to be first out of the gate for moments like now when the economy shows signs of rebound and restoration.

Cost and product delivery are two key drivers of our residential business model. Our decision early on to build Dreambuilders Pro, Inc., our in-house construction company, has allowed us to compete on these two fronts successfully. It was good foresight, and we now see its benefits. We see most of our projects built by DPI display gross profit margin improvements and allow us to deliver our products with better quality and timing to our customers. DPI is currently constructing eight MRB projects (17 buildings), two HRB projects and has orders for more than 3,000 housing units across the country.

In line with our vertical integration efforts, we also completed our Concrete Batching Plant (CBP) and Pre- fabricated building forms factory in Calamba, Laguna. We will be able to supply our concrete requirements, particularly in Metro Manila, Laguna, and Cavite areas. We expect to bump up the gross profit margins in the projects in these areas due to savings we anticipate from our concrete self-supply model.

We have also accelerated our construction progress with more work shifts as labor supply becomes more available and community mobility restrictions are lifted. We expect to complete more buildings and houses this year compared to previous years as we accelerate orders of construction supplies needed to complement the increased working hours we require on our construction sites.

We knew that as restrictions are lifted, more customers would be eager to check the progress and actual unit they purchased on site. We have also added more customer fulfillment staff and tasked them to reach out to our qualified customers to accelerate the completion of buyers’ unit acceptance and turnover.

We shifted aggressively to digital marketing and online solutions starting in 2020 to adjust to the new normal and saw many of these digital projects completed in 2021. We developed the Online Sellers’ Hub, Buyer Purchase and Payment Portals, and the Customer Helpdesk. We also introduced digital portals like MyHome App, a digital butler for residents of our residential communities, and E-settle, a digital solution to release billing payments to contractors and suppliers online through EastWest Bank.

We updated and uploaded more site drone videos, provided more interactive images of unit interiors, and created digital versions of the views from our lots, condos, and housing units for sale. We continued to shift to digital versions from printed flyers and uploaded all marketing materials to the Online Sellers’ Hub. We made all our sales and marketing materials accessible to our sellers anytime, mobile versions included.

We also continued to task our property management arm, Pro-Excel Property Managers, Inc. (Pro-Excel), to assist our residents in procuring essentials amid the lockdowns and restrictions. To this end, ProExcel has continued to organize small community markets and group deliveries, which provided residents with safer alternatives to buying their essentials. We observed that these particular services resonated with our residents and brought about positive feedback that strengthened our word-of-mouth endorsements.

As the economy continues to open up and restrictions are slowly lifted, your residential business has started to conduct in-person sales and marketing activities to become more responsive to the demand of both sellers and clients requesting more personal and accessible collaborations.

We have also cautiously returned to on-site open houses and in-person closing events. We now hold weekly project exhibits and sales displays in malls where foot traffic has improved tremendously. We do this while we continue to develop more digital marketing materials and distribute them to clients and sellers alike online.

In 2021, we focused on expanding our seller network. We maximized digital platforms for recruitment, including our Online Recruitment Facility, where end-to-end recruitment processes are seamlessly done online. We also ensured that our sellers were well-prepared as we conducted comprehensive training programs for them on sales management, leadership, and customer service excellence.

We created an e-learning platform for sellers to make learning more convenient and efficient. These allowed our residential business to grow its sales versus 2020 and show trends that 2022 will be the year that we can return to the pre-pandemic sales level.

We now focus our attention on sustainability and what we are doing for the environment. COVID-19 sharpened our focus on the environment and further awakened the urgent need to take individual responsibility to save our environment and shift to sustainable solutions in conducting our business.

We in FLI take an owner’s mentality in solving sustainability and saving our environment, which allows us to pursue meaningful solutions to the various problems we have today. Our projects are designed to be energy efficient, tap renewable energy sources, use sustainable building materials, and reduce construction waste. Our MRB, housing, and subdivision projects are low-density developments with broader and bigger open spaces. We even have a vehicular, roadless condo community in our Amalfi Oasis project in Cebu, providing more extensive and safer park spaces for our residents.

We now have detention ponds, rainwater collectors, sewage treatment plants (STP), and water recycling systems that provide an additional water source for irrigation and landscape maintenance.

Actions towards sustainability are not the only the right thing to do moving forward. Given the changing preference of our market towards environmental commitment, taking ownership for a more sustainable future is also the smart thing to do moving forward.

Agility and speed will be the new basis for differentiation. Together with strong communications, we saw a lot of proof of how these combinations have allowed us to respond more effectively to the crisis. Many of our past learnings have been upended, and the need to continually learn has become more evident to allow us to continue to adapt to today’s crisis and prevent the next one.

The past two years have prepared us well. We are optimistic that we will be able to sustain in 2022 the growth trajectory we achieved in 2021 and more. We remain steadfast in providing our buyers with superior and value-for-money homes as we make Dreams Built Green a reality.

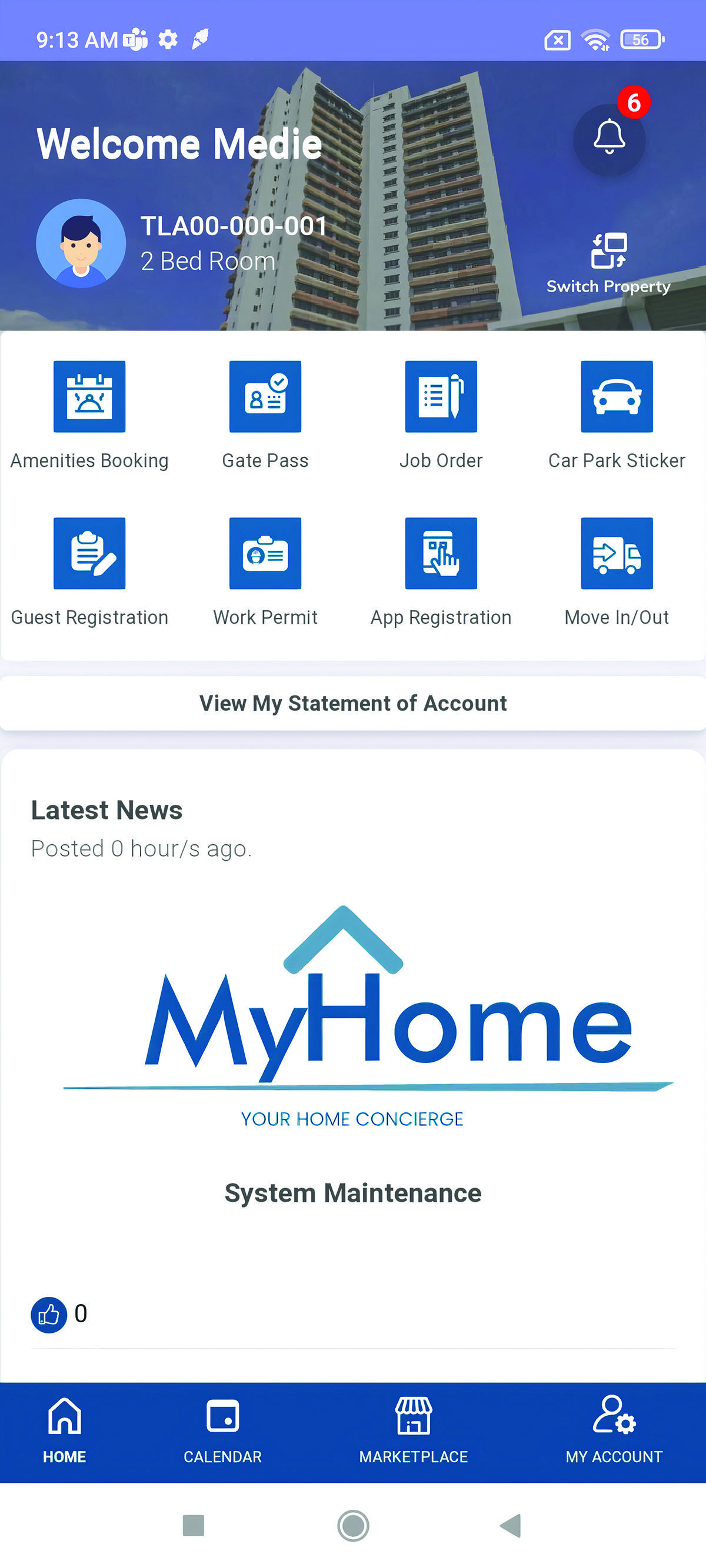

My Home App

To further enhance customer excellence within its communities, FLI launched the Property Management app called MyHome. This app serves as a channel for unit owners and residents to connect remotely with the Property Management Office. This initiative follows through on our commitment to migrate to a paperless and contactless environment.

The app is a web-based support system which allows unit owners to log and track their property management-related requests, upload proof of theior payments, view their Statements of Account and community announcements and have a ready reference on the House Rules. MyHome is not yet available for download from Playstore and Appstore, but may be accessed through any web browser.

MyHome evolved into 3 different personas to represent the 3 Filinvest brands, namely Alfred eButler for Filigree and Prestige, Pocket Fred for Aspire, and Pocket Flor for Futura. The available modules in the app are:

- Service Requests – wherein users may request for the following services:

- Work Permits

- Job Orders

- Car Park Sticker

- Gate Pass

- Move In and Move Out

- Amenity Reservation

- Guest Registration

- Pet Registration(where pets are allowed)

- Statement of Account – where the summary of the most recent SOA may be viewed

- Proof of Payment – instead of emailing, unit owners may submit the proof of payment via the app

- House Rules - for related service requests

- Latest News – wherein circulars and latest community news are posted

- Submit a Feedback - where they can send their concerns, comments and suggestions

- Add User – wherein unit owners can add their tenants, representatives, family member or other authorized occupants of the unit to have access to the app

Dreams Built Green

As the world continued to ride the waves of the pandemic in 2021, people have realized how valuable green spaces are. Now, nature-oriented developments are at the forefront of every real estate developer’s mind.

Even before this increased focus on green developments, Filinvest Land, Inc. (FLI) has been creating green communities for more than 50 years. The catchphrase ‘Dreams Built Green’ encapsulates our company’s long-term commitment as we take on the responsibility to lead with sustainable, future- forward principles to ensure healthy and quality living.

FLI’s green-centric thrust is anchored on three main pillars – green, health, and life tech – which translate to a holistic and nurturing lifestyle for the new normal and beyond.

Green

We bring the benefits of nature to our communities with biophilic designs that incorporate green (and blue) into everyday life. Most of our projects have parks, lush greens, and breathtaking vistas that preserve the natural topography like rolling terrain, waterways, and forests. All these serve as a balm for nature-deficit disorder, which many people experienced amid the lockdowns and quarantines.

This is best experienced in projects like Mira Valley and The Peak, hillside developments within the Havila townscape in Rizal. Here, built and natural environments coexist with amenities like viewing decks and meditation gardens. Another verdant sanctuary is Nusa Dua, where the fertile fields are ideal for therapeutic pursuits such as hobby farming.

Health

We also place a premium on physical and mental well-being in our developments. Our resort- themed condo communities such as Panglao Oasis and Maldives Oasis allot 60 to 70 percent to leisure amenities and open spaces where residents can lead an active lifestyle amid low-density environs. They also employ the Venti-lite architectural concept that features sky gardens and air wells for an abundant flow of natural light and ventilation, which impacts energy conservation across all units.

Other developments, such as the Amalfi mid-rise enclave in Cebu, have tree-lined roads, bikeable or walkable pathways, and carless streets where children can play and people can exercise safely.

Life Tech

Convenience and productivity are essential, which became more evident when our lives were disrupted by the pandemic. FLI’s communities in key cities and suburban areas are strategically positioned to provide seamless access to life’s essentials.

From horizontal communities to mid-rise and high-rise condos, we strive to empower residents by creating flexible living spaces primed for fiber internet to support work-from-home and remote- learning setups.

Ease and connectivity are also paramount in our transit-oriented developments. Activa in Quezon City allows its residents to have easy access to EDSA, Aurora Boulevard, MRT-3, and LRT-2, being at the crossroads of the metro’s two major thoroughfares. Other mixed-use developments such as Studio 7 and 100 West also combine living, working, and leisure with practically everything just an elevator ride away.

Focus on sustainability

Dreams Built Green is a lifelong commitment for FLI as we move forward with a development footprint that is earth-friendly and sustainable. In line with this, we also continue to implement other green initiatives as part of our corporate social responsibility.

We were able to decrease our water consumption by 86% from 2019 to 2020 and recycled 70,000 cubic meters of water. Over the same period, FLI also reduced energy consumption by 18% and increased consumption of renewable energy to over 90kWh. We also contributed to cleaner air by reducing direct greenhouse gas emissions by 59%.

Under our annual Keep It Green program, we have planted a total of 51,000 trees since it started in 2010. We have also participated in coastal clean-up activities to help save our bodies of water. We also strive to promote this green campaign across our organization so our employees can apply sustainability practices in the workplace and in their homes.

We will continue to build the Filipino dream with a mindset for sustainability to ensure that future generations can thrive and enjoy the quality of life they deserve.

Creating Sustainable Communities

Havila Township

Havila is a sustainable township development located in the mountainous & natural landscape of the East offering valuable homes to various market segments. Having an elevation of more than 200 meters above sea level, it covers more than 300 hectares nestled across the uplands of Taytay, Antipolo, and Angono, Rizal . It offers breathtaking views of the Metro Manila Skyline, Sunset and Laguna de Bay. Havila is covered with the natural beauty of nature, lush rolling terrain and picturesque scenic views.

Spotlight: Mira Valley

Mira Valley is located in Sitio Colaique, Brgy. San Roque, Antipolo City, within the sprawling Havila Township. Major cities and modern conveniences are easily accessible. It features nature- inspired amenities such as a river park, meditation garden, view deck, gazebo and mini events area. It is also characterized by modern-minimalist homes. Blessed with natural waterways, this is a refreshing community built for the Filipino family.

One-Filinvest-Facade

"The office segment is expected to continue to grow in the long term driven by demand from BPOs specifically from emerging technology such as e-commerce and online payment firms, IT, logistics HO, and healthcare."

Filinvest Land Offices are characterized by well-built and maintained buildings with sustainability features. These are located in key major cities across the country, highly accessible to transportation networks and near residential communities the highly-educated workforce live.

In 2021, FLI sold 36.7% of its ownership in FILRT (formerly CPI) to the public which includes 16 buildings in Northgate Cyberzone and 1 builiding in Cyberzone Cebu. The balance of existing offices and those under construction remain to be 100% owned by FLI.

FLI’s current office portfolio consists of 31 operational office developments, 17 of which are in FILRT. FLI also has 13 office buildings under construction.

For 2022, FLI expects to complete 11 projects located in Northgate Cyberzone Alabang, Clark Mimosa, Quezon City, Makati CBD and Ortigas CBD bringing FLI’s total office portfolio to 743,406 sqm. (including 301,000 sqm. under FILRT). These are the upcoming buildings expected to be operational by the end of 2022:

Clark Workplus

- 4WorkPlus and 7WorkPlus located in Clark Mimosa with a combined GLA of 25,251 sqm.

- Studio 7 located in Quezon City with a GLA of 36,541 sqm.

- Axis Towers 3 and 4 located in Northgate Cyberzone Alabang with a combined GLA of 78,680 sqm.

- 387 Gil Puyat located in the Makati CBD with a GLA of 10,668 sqm.

- Filinvest Cyberzone Cebu Tower Three with a GLA of 18,368 sqm.

- One Filinvest located in the Ortigas CBD with a GLA of 39,759 sqm.

- Marina Town located in Dumaguete with a GLA of 4,225 sqm.

- Columna located in Binondo Manila with a GLA of 8,870 sqm.

- Filinvest Cyberzone Cebu Tower Four with a GLA of 20,350 sqm.

The office segment is expected to continue to grow in the long term driven by demand from BPOs specifically from emerging technology such as e-commerce and online payment firms, IT, logistics HO, and healthcare.

Sustainability Features

Aligned with the Filinvest Group’s sustainability road map, FLI is not limiting itself with securing Leadership in Energy and Environmental Design (LEED) Gold for its Axis Towers. In addition, WELL Silver certification is also being pursued for Axis Tower Two.

WELL CONCEPTS

There are 10 concepts in WELLv2:

Other notable sustainability features and building improvements:

For all buildings:

- Improvement of Indoor Air Quality by upgrading to MERV 8 to 13 filters;

- Renewable source of energy for office buildings: - Switch qualified buildings to RES with 100% source from renewable power generation plants - Pilot buildings for renewable sources of energy i.e. solar

- Mechanical upgrades are being studied to increase air flow within the building as an added mitigation to risk of viral spread.

All these features ensure that FLI offices are environment- friendly and energy sufficient.

For older buildings:

- Building Management System (BMS) upgrade and centralization by 2024

- Elevator modernization by 2024

- Restroom modernization with touch-free fixtures by 2024

- Indoor air quality improvement of older buildings through upgrading of ventilation equipment and MERV filtration beyond requirement by 2023

- Visitor Management System by 2024 and Gate Access System (turnstiles) for applicable buildings by 2027

- Security improvement through centralized CCTV monitoring by 2024

Mimosa Plus WorkPlus Buildings

The Mimosa Plus Leisure City is a sprawling 201-hectare master-planned township property development by Filinvest. It is a mixed-use development with several components: Business, Leisure, Living, Hospitality, Retail, Tourism, Tourism, and Wellness to name a few. Filinvest Mimosa+ is truly a destination for everyone as it offers a live-work-play lifestyle Plus a lot more.

An integral part of Filinvest Mimosa+ is WorkPlus- an office campus type setting which is set to provide investors and entrepreneurs a location to grow and expand their business. It will be home to up to twelve midrise office buildings with fiber optic facilities, podium and ground level parking and a retail area at the ground floor amongst others. Tenants and employees will enjoy the serene and green surrounding that Filinvest Mimosa+ uniquely offers for that much-coveted wellness in the workplace.

Two buildings are currently operational while two more buildings, Workpus 4 and Workplus 7, are near full handover, which will bring total GLA in the hub to 45,969 sqm. by the end of 2022. All buildings have retail area on the ground floor and are equipped with advanced fiber optic facilities.

Eight other WorkPlus buildings are in the pipeline and are planned to be rolled out in the next 5-7 years to total up to more than 143,000 GLA square meters of office and retail spaces.

WorkPlus will attract locators not only because of its state-of-the-art features but also because of its refreshing, green campus environment. People working here will be inspired to be productive because of the work-life balance that it offers.

Its proximity to the Clark International Airport makes it an ideal base for workers who need to travel on a regular basis. Surrounded by nature, Workplus offers work-life balance with a vast golf course and other leisure components within Clark Mimosa Plus. It will also be complemented by four towers of The Crib, a residential complex of dormitels which will offer accessible accommodations to people working within Work Plus.

WorkPlus is an important component of this township, together with the 130-ha golf course and the luxurious Quest Plus Conference Center as they complement each other to provide a balanced mix of developments. This project also brings us closer to our vision of making Filinvest Mimosa+ a top-of-mind, year-round business and leisure destination.

Filinvest Mimosa+ will further enhance this nature sanctuary with the addition of outdoor parks, safe and wide pedestrian paths as well as biking zones. The heart of which is the beautifully landscaped Acacia Park. Like all Filinvest townships, this will be a place that encourages wellness and peace through awe-inspiring and functional outdoor spaces.

Lastly, FILINVEST Mimosa+ Leisure City is cementing its stature as a world class, live-work-play township after bagging the Best Mixed-Use Development in the Philippines Award at the recent Asia Pacific Property Awards 2021. This recognition is a testament of our commitment to transform lives through urban developments that offer all the conveniences and security to our customers. Filinvest Mimosa+ was lauded for its vision to be a Leisure City in Central Luzon, delivering three key promises: to be an accessible urban escape, be a self-contained eco-community, and become a global micro-district.

Festive-Mall

Lifemalls by Filinvest

Lifemalls by Filinvest, the commercial leasing segment of Filinvest Land, slowly recovers as it continues to find ways to reconnect with its stakeholders to provide a safe and reliable retail experience. By providing a hybrid mall set- up, where physical mall can be seen in the digital space, Lifemalls by Filinvest was able to respond to the evolving retail landscape that the pandemic pushed forward.

Lifemalls provided rent subsidy to its tenants resulting to a stable occupancy level across all malls. To further support tenants and offset the leasing concessions given, temporary pop-up stores were allowed in common areas of the malls that provides flexibility in rates and terms.

Lifemalls by Filinvest sealed partnerships with renowned dining concepts such as Bistro Group and Wildflour. Bistro Group will open four concepts in Festival Mall – the first Las Flores in Southern Metro Manila at the ASVL Heritage Building, TGIFridays, Itallianis, and Watami.

In an effort to stay relevant, the Lifemalls brand was recalibrated to keep up with the evolving retail landscape. After establishing a Lifemall as the center of a Filinvest township development focusing on the place and purpose, the brand now shifts its focus on its communities by connecting through their personal experiences and affinity with the malls. With the unveiling of a refreshed Lifemalls logo, it now strengthens the brand image and highlights the value proposition of Celebrating Everyday Moments at Lifemalls. Together with the implementation of health and safety protocols in accordance with government guidelines, Lifemalls continues to bring back the confidence of the shoppers to the retail area.

Lifemalls capitalized on its natural environment within the mall to provide better and safer dining options through its Alfresco Dining concepts. With more than 40% of the total land area allocated for open spaces, the Outdoor Food Fest at Festival Mall, Alabang and Food Yard at IL Corso, Cebu, helped increased foot traffic and consistent visits especially on weekends.

The MyShopper microsite was also launched in 2021 as a platform for those patrons who are looking for ways to shop with ease and convenience. Over 600 participating Festival Mall tenants are now enrolled in the microsite, allowing Ana, Lifemalls personal shopper, to assist mall patrons with their online shopping. Justpayto, a new payment gateway, alongside Gcash and other mobile bank facilities, helped bridge the gap for a more secure payment process.

As the new normal inspires everyone to be more relevant with the current needs of the community, Lifemalls’ offerings, together with the programs for mall patrons and tenants, help deliver everyday moments that are safe, rewarding and sustainable.

Lifemalls is Filinvest group of malls that offers a wide range of shopping, dining and leisure options for varied lifestyles – from regional shopping centers to community malls. These Lifemalls are Festival Mall in Alabang, Main Square in Bacoor, Fora in Tagaytay and IL Corso in Cebu. In today’s new norm, Lifemalls brings together a redefined lifestyle of safety, comfort and ease to the communities where they are located.

"As the new normal inspires everyone to be more relevant with the current needs of the community, Lifemalls’ offerings, together with the programs for mall patrons and tenants, help deliver everyday moments that are safe, rewarding and sustainable."

Reinventing the Retail Mall

At the close of 2021, we continue to wrestle with the reality of COVID-19’s impact from the global economy. But we have learned that we can rise above by embracing the new shopping behaviors of customers altered by the pandemic. The rise in digital consumers led us to adapt to this new way of shopping through digital platforms, and we anticipate that post-COVID, these consumers shall continue to use these digital services. During this period, quarantine protocols and consumer confidence continue to adversely affect mall operations and foot traffic. Our response to this: To be able serve our customers better, we had to switch to online retailing through the use of online platforms, offer alternative options to dining and conversion of retail spaces to temporary formats and repurposing spaces for storage.

Outdoor is In

With 40% of the total land area allocated for open spaces, the al fresco areas of Festival and Il Corso Malls have created the gold standard for outdoor dining experience in Southern Metro Manila and Cebu.

Brick and Click: MyShopper

To provide shoppers with more options while they stay at home, we have launched the MyShopper microsite to help customers easily shop at their favorite stores. We also sealed a partnership with Justpayto-a payment acceptance gateway facility or the e-commerce component of MyShopper.

New Lease Formats

Pop-up stores and temporary store set-ups offered new shopping options to consumers.

Filinvest Innovation Park New Clark City Aerial View

Filinvest Innovation Park New Clark City

FLI completed plans for the construction and development of its Ready-Built Factory (RBF) compound in the park. The RBF compound will feature ten units of the Prime model RBF to be built on a 40,000-sqm compound tailor- fit for this purpose. Each of the 2,500-sqm Prime RBF units is designed for logistics, e-commerce and light manufacturing locators, with 8-meter-high clear ceiling height, floor load capacity of 3 tons per square meter and a two-bay loading dock. Two units are slated for the initial batch to be constructed for completion in the 4th quarter of 2022. The RBFs are expected to be leased and operational by the 1st quarter of 2023.

In November, land development of the 1-hectare Administration area commenced in preparation for the construction of FIP-NCC’s Administration building complex – slated to commence also in 2022. The construction of the Park’s main entrance complex will round out the development of the Park’s amenities and facilities scheduled for completion by early 2023.

Filinvest Innovation Park Ciudad de Calamba

Detailed planning has been completed for the 23-hectare FIP-CDC. Development work is expected to commence by the 2nd quarter of 2022 after the company secures the requisite permits. FLI has also started the process of applying for PEZA registration of the Park.

In July, planning also commenced for the development of RBF units in an area of the existing Filinvest Technology Park originally reserved for the development of a retail commercial strip. The recent plan to develop a larger central commercial zone within the CdC township made possible the re-purposing of this 4.7-hectare, 2-block area into an industrial strip. Ten RBF units similar in design and specifications to the RBFs in FIP-NCC are planned for this area, with an initial batch of four units slated for development starting the 2nd quarter of 2022.

"It is envisioned to be a world class Industrial Park within an accessible, sustainable and future-ready township.”

Crib Aerial View

"These spaces allow them to stay connected technologically with WiFi enabled facilities."

With the rising need for safe, secure, healthy and affordable accommodations for the young and mobile workers in prime growth locations, Filinvest has ventured into the co-living market under “The Crib” brand. These spaces allow them to stay connected technologically with WiFi enabled facilities.

The Crib Clark, Pampanga shall be the first project and is composed of four low-rise buildings with a total of 552 rooms. The Crib Mimosa+ is seen to cater to the accommodation needs of employees and corporations within Clark Freeport Zone.

Building the dream together towards a COVID-free community

As soon as COVID-19 ravaged the country affecting families and businesses alike, Filinvest Development Corporation together with its foundations and subsidiaries sprung into action to help the government protect Filipino families all over the country against the virus. The company’s response was three-pronged: taking care of the business, our employees, and our community. The Filinvest group weathered the COVID crisis thanks in part to agile decision-making, strategic business continuity plans, well-instituted health and safety protocols, and an accelerated digitalization journey. The company pledged Php 100 Million for the fight against COVID-19 and has gone well beyond the pledged amount through various initiatives designed to help fight COVID-19.

The company welcomed 2021 with a renewed sense of optimism aptly inspired by the rapid development and effective roll-out of vaccines which add a new layer of protection against COVID-19. As the year went by, the Filinvest group remained steadfast in its commitment to helping the country fight the pandemic from providing COVID care kits, free vaccines, to sending medical-grade facemasks to the provinces.

FILVAX

Filinvest Group’s free, nationwide vaccination program FilVax for employees, drivers, messengers, utility workers, sales people, and security guards assigned to FDC properties and workspaces nationwide kicked off last August 4, 2021. Held at the Filinvest Mega Vaccination Center at Festival Mall, Filinvest City, Muntinlupa, the event was led by Filinvest Land, Inc. (FLI) Director Francis Gotianun and EastWest Banking Corporation (EWB) Director Isabelle Gotianun Yap, with Muntinlupa City Mayor Jaime Fresnedi as the guest of honor. Other Filinvest Mega Vaccination Centers across the country such as Clark, Cebu, Misamis, and Davao were also opened during the year.

The Filinvest Group procured 100,000 Oxford-AstraZeneca vaccine doses through the help of the national government. Part of the doses were donated to communities where businesses of the Filinvest Group operate.

By year-end, a total of 11,348 employees of the Filinvest group have been vaccinated accounting for 93.16% of the Filinvest group’s total workforce.

"FilVax is only one of the entire group’s synergistic efforts in ensuring that we keep the Filinvest family safe and healthy as we continue to respond to the needs of our stakeholders,”

- Josephine Gotianun Yap, FDC President and CEO

"FilVax’s message is to #FilFreeFilSafe. We want to keep our employees, partners, workplaces, and properties safe and healthy for all."

- Isabelle Gotianun Yap

"We want our customers and business partners to FilFree to come to us and FilSafe to work with us. Our vaccination track record is a strong testament to this commitment."

- Francis Gotianun

The Filinvest Group kicks off FILVAX #FilFreeFilSafe conglomerate- wide vaccination program with a ribbon cutting ceremony led by guest of honor Muntinlupa City Mayor Jaime Fresnedi, Muntinlupa OIC City Health Officer Dr. Juancho Bunyi together with FLI Director Francis Gotianun, EWB Director Isabelle Gotianun Yap, FLI EVP and Chief Strategy Officer Tristan Las Marias, and FLI SVP and Business Group Head for Mixed-use and Retail Joselito Santos.

Cooperation Agreement Signing Ceremony with the Province of Cebu for the donation of 2,000 Oxford-AstraZeneca Vaccine Doses

Employees of the Filinvest group awaiting their turn to receive the vaccine at the Filinvest Mega Vaccination Center in Filinvest City, Muntinlupa

Misamis Oriental Governor Yevgeny Emano receives surgical facemask donation from FDC Utilities

Quezon City Mayor Joy Belmonte receives surgical facemask donation from Filinvest Land

"The fight against the pandemic is a long one and when like-minded partners work together, we can help our communities to overcome these challenging times. We are grateful to partner with the Filinvest group and the Embassy of the Philippines in Singapore to support the Philippines in tackling COVID-19. This most recent donation of 2 million masks comes on the back of earlier initiatives in the past year, including the donation of essential items and medical equipment. We hope that these will go a long way in helping the community to manage the situation.”

- Temasek Foundation International Chief Executive, Benedict Cheong

Distribution of 2 Million Facemasks

Singapore-based Temasek Foundation sent 2 million medical-grade surgical facemasks to the Philippines in support of the country’s ongoing fight against COVID-19. Temasek Foundation is the non-profit philanthropic arm of Singapore investment company, Temasek Holdings.

This donation is part of Temasek Foundation’s Stay Masked program where they distribute medical grade surgical facemasks for added coverage, protection and assurance. The Stay Masked program is a key component of Stay Prepared, a Temasek Foundation initiative to help prepare communities for emergencies. Temasek Foundation partnered with the Ambassador of the Republic of the Philippines to Singapore, H.E. Joseph del Mar Yap and the Filinvest group and its foundations for its donation to the Philippines.

Filinvest shouldered the shipment and distribution cost of the 2 million facemasks from Singapore to 27 priority cities, municipalities, and provinces nationwide. The facemasks have been donated and received by the local government units of Quezon City, Manila City, Taguig City, Makati City, Pasig City, Muntinlupa City, Davao City, Municipalities of San Nicolas, Villanueva, and Tagoloan in Misamis Oriental, Province of Misamis Oriental, Cagayan de Oro City, Dagupan City, San Jose del Monte City in Bulacan, Municipality of San Mateo in Rizal, Zamboanga City, Balanga City in Bataan, Dumaguete City, Tagaytay City in Cavite, Cebu City, Talisay City, and Lapu-lapu City in Cebu, the Province of Cebu, Municipality of Malay in Aklan, Municipality of Matalam in Cotabato, and Municipality of Hagonoy in Davao del Sur.

Stay Safe COVID-19 Communication Program

To help keep employees safe and healthy against COVID-19, the Filinvest group continued its Stay Safe employee communications program. Stay Safe provided COVID-prevention tips, wellness ideas, as well as news and updates for employees across the conglomerate.

With uncertainties and rampant misinformation on COVID variants and the vaccines, Stay Safe educated the employees by using verified, accurately-sourced articles, infographics, and videos.

Community Handwashing Stations

Washing of hands is one of the first defenses against the COVID-19. The Filinvest group provided handwashing facilities for the host communities of FDC Misamis Power Corporation. This aimed to ensure that residents have easy access to handwashing facilities in their respective barangays.

Community Handwashing Stations were installed in Barangays Tambobong and Balacanas in Villanueva and Barangays Mohon, Sta. Ana, Baluarte, and Sta. Cruz in Tagoloan, as well as the Kalingagan National Highschool.

For the year 2021, FLI substantially complied with the Philippine Stock Exchange (PSE) and the Securities and Exchange Commission (SEC) regulatory requirements. It is also in compliance with its Revised Manual for Corporate Governance. In particular, your Company wishes to highlight the following: (a) the election of three (3) independent directors to the Board; (b) the appointment of members of the Executive Committee, the Audit and Risk Management Oversight Committee, the Compensation Committee, the Technical Committee, the Related-Party Transaction Committee, and the Corporate Governance Committee; (c) the conduct of regular quarterly board meetings and special meetings, the faithful attendance of the directors at these meetings and their proper discharge of duties and responsibilities as such directors; (d) the adoption of the Related Party Transaction Policy; (e) the submission to the SEC of reports and disclosures required under the Securities Regulation Code; (f) the submission of sustainability report, (g) FLI’s adherence to national and local laws pertaining to its operations; and (h) the observance of applicable accounting standards by FLI.

In order to keep abreast of best practices in Corporate Governance, the members of the Board and top management have attended seminars on corporate governance initiated by duly accredited institutions. FLI constantly reviews its Corporate Governance practices and welcomes proposals, especially from institu-tions and entities such as the SEC, PSE and the Institute of Corporate Directors.

Leading the practice of good Corporate Governance is the Board of Directors. Your Board of Directors is firmly committed to the adoption of and compliance with the best practices in Corporate Governance as well as the observance of all relevant laws, regulations and ethical business practices.

Nominations and Voting for the Board of Directors

The members of the Board are elected during the annual stockholders’ meeting. The stockholders of FLI may nominate individuals to be members of the Board of Directors.

The Corporate Governance Committee, acting as the Nomination Committee, receives nominations for independent directors as may be submitted by the stockholders. After the deadline for the submission thereof, the Corporate Governance Committee, acting as the Nomination Committee meets to consider the qualifications as well as grounds for disqualification, if any, of the nominees based on the criteria set forth in FLI’s Revised Manual on Corporate Governance and the Securities Regulation Code. All nominations shall be signed by the nominating stockholders together with the acceptance and conformity by the would-be nominees. The Corporate Governance Committee, acting as the Nomination Committee shall then prepare a Final List of Candidates enumerating the nominees who passed the screening. The name of the person or group of persons who recommends nominees as independent directors shall be disclosed along with his or their relationship with such nominees.

Only nominees whose names appear on the Final List of Candidates shall be eligible for election as independent directors. No other nomination shall be entertained after the Final List of Candidates shall have been prepared. No further nomination shall be entertained or allowed during the annual meeting.

It shall be the responsibility of the Chairman of the annual meeting to inform all stockholders in attendance of the mandatory requirement of electing independent directors. He shall ensure that independent directors are elected during the annual meeting. Specific slots for independent directors shall not be filled up by unqualified nominees. In case of failure of election for independent directors, the Chairman of the meeting shall call a separate election during the same meeting to fill up the vacancy.

A stockholder may vote such number of shares for as many persons as there are directors to be elected. He may cumulate said shares and give one candidate as many votes as the number of directors to be elected multiplied by the number of his shares, or he may distribute them on the same principle among as many candidates as he shall see fit; Provided, that the total number of votes casted by him shall not exceed the number of shares owned by him as shown in the books of FLI multiplied by the whole number of directors to be elected.

The directors of FLI are elected at the annual stockholders’ meeting, to hold office until their respective successors have been duly appointed or elected and qualified. Vacancies in the Board occurring mid-term are filled as provided in the Revised Corporation Code and FLI’s Revised Manual on Corporate Governance. Officers and committee members are appointed or elected by the Board of Directors typically at its first meeting following the annual stockholders’ meeting, each to hold office until his successor shall have been duly elected or appointed and qualified.

Independent Directors Before the annual meeting, a stockholder of FLI may nominate individuals to be independent directors, taking into account the following guidelines:

- “Independent director” means a person who, apart from his fees and shareholdings, is independent of management and free from any business or other relationship which could, or could reasonably be perceived to, materially interfere with his exercise of independent judgement in carrying out his responsibilities as director in any corporation that meets the requirements of Section 17.2 of the Securities Regulation Code and includes, among others, any person who:

- Is not a director or officer or substantial stockholder of FLI or of its related companies or any of its substantial shareholders (other than as an independent director of any of the foregoing);

- Is not a relative of any director, officer or substantial stockholder of FLI, any of its related companies or any of its substantial shareholders. For this purpose, “relative” includes spouse, parent, child, brother, sister, and the spouse of such child, brother or sister;

- Is not acting as a nominee or representative of a substantial shareholder of FLI, any of its related companies or any of its substantial shareholders;

- Has not been employed in an executive capacity by FLI, any of its related companies or any of its substantial shareholders within the last two (2) years;

- Is not related as a professional adviser of FLI, any of its related companies or any of its substantial shareholders within the last two (2) years, either personally or through his firm;

- Has not engaged and does not engage in any transaction with FLI or any of its related companies or any of its substantial shareholders, whether by himself or with other persons or through a firm of which he is a partner or a company of which he is a director or substantial shareholder, other than transactions which are conducted at arms-length and are immaterial or insignificant.

- When used in relation to FLI, subject to the requirements above:

- “Related company” means another company which is: (a) its holding company, (b) its subsidiary, or (c) a subsidiary of its holding company; and

- “Substantial shareholder” means any person who is directly or indirectly the beneficial owner of more than ten percent (10%) of any class of its equity security.

- An independent director of FLI shall have the following qualifications:

- He shall have at least one (1) share of stock of FLI;

- He shall be at least a college graduate or he shall have been engaged in or exposed to the business of FLI for at least five (5) years;

- He shall possess integrity/probity; and

- He shall be assiduous.

- No person enumerated under Part II, Item A, Par. 8 of the Revised Manual of Corporate Governance shall qualify as an independent director. He shall likewise be disqualified during his tenure under the following instances or causes:

- He becomes an officer or employee of FLI, or becomes any of the persons enumerated under items (A) hereof:

- His beneficial security ownership exceeds 10% of the outstanding capital stock of FLI;

- He fails, without any justifiable cause, to attend at least 50% of the total number of board meetings during his incumbency unless such absences are due to grave illness or death of an immediate family member;

- If he becomes disqualified under any of the grounds stated in FLI’s Revised Manual on Corporate Governance.

- Pursuant to SEC Memorandum Circular No. 04, Series of 2017, the following additional guidelines shall be observed in the qualification of individuals to serve as independent directors:

- The independent director shall serve for a maximum cumulative term of nine (9) years;

- After which, the independent director shall be perpetually barred from re-election as such in the same company, but may continue to qualify as nonindependent director;

- In the instance that a company wants to retain an independent director who has served for nine (9) years, the Board should provide meritorious justification/s and seek shareholders’ approval during the annual shareholders’ meeting; and

- The reckoning of the cumulative nine-year term is from 2012.

Members of the Board of Directors, Attendance and Committee Memberships

The following table lists down the members of the Board of Directors and their attendance in Board Meetings in 2021.

| Board | Name | Date of Election |

No. of Meetings Held during the year |

No. of Meeting Attended |

% |

|---|---|---|---|---|---|

| Chairman | Jonathan T. Gotianun | April 23, 2021 | 8 | 8 | 100% |

| Member | Lourdes Josephine Gotianun-Yap | April 23, 2021 | 8 | 8 | 100% |

| Member | Michael Edward T. Gotianun | April 23, 2021 | 8 | 8 | 100% |

| Member | Francis Nathaniel C. Gotianun | April 23, 2021 | 8 | 8 | 100% |

| Member | Efren C. Gutierrez | April 23, 2021 | 8 | 8 | 100% |

| Member | Nelson M. Bona | April 23, 2021 | 8 | 5 | 63% |

| Independent | Val Antonio B. Suarez | April 23, 2021 | 8 | 8 | 100% |

| Independent | Ernesto S. De Castro | April 23, 2021 | 8 | 8 | 100% |

| Independent | Gemilo J. San Pedro | April 23, 2021 | 8 | 8 | 100% |

Committee Membership

| Name | Position |

|---|---|

| Mr. Jonathan T. Gotianun | Chairman of the Board Member – Executive Committee Member - Audit & Risk Management Oversight Committee Member – Compensation Committee Member – Corporate Governance Committee |

| Mrs. Lourdes Josephine Gotianun-Yap | President and Chief Executive Officer Chairperson – Executive Committee Member – Compensation Committee |

| Mr. Michael Edward T. Gotianun | Member – Executive Committee Member – Technical Committee |

| Mr. Francis Nathaniel C. Gotianun | Member – Executive Committee |

| Atty. Efren C. Gutierrez | Member – Audit & Risk Management Oversight Committee Member- Related-Party Transaction Committee |

| Atty. Val Antonio B. Suarez | Lead Independent Director Member – Audit & Risk Management Oversight Committee Chairman – Compensation Committee Chairman – Related-Party Transaction Committee Chairman – Corporate Governance Committee |

| Engr. Ernesto S. De Castro | Independent Director Chairman – Technical Committee Member – Corporate Governance Committee |

| Mr. Gemilo J. San Pedro | Independent Director Chairman – Audit & Risk Management Oversight Committee Member – Compensation Committee Member – Related-Party Transaction Committee Member – Corporate Governance Committee |

Duties and Responsibilities of the Different Board Committees

Committee Members

| Office | Name | Date of Appointment |

No. of Meetings Held |

No. of Meetings Attended |

& |

|---|---|---|---|---|---|

| Chairperson | Lourdes Josephine Gotianun-Yap | April 23, 2021 | 9 | 9 | 100% |

| Member | Jonathan T. Gotianun | April 23, 2021 | 9 | 8 | 89% |

| Member | Michael Edward T. Gotianun | April 23, 2021 | 9 | 9 | 100% |

| Member | Francis Nathaniel C. Gotianun | April 23, 2021 | 9 | 9 | 100% |

| Member | Andrew T. Gotianun, Jr.** | April 23, 2021 | 9 | 2** | 22% |

*Committee members are appointed annually.

** Mr. Andrew T. Gotianun, Jr. passed away on May 21, 2021.

The functions, duties and responsibilities of the Board of Directors may be delegated, to the fullest extent permitted by law, to an Executive Committee to be established by the Board of Directors. The Executive Committee shall consist of five (5) members, at least three (3) of whom shall be members of the Board of Directors. All members of the Executive Committee shall be appointed by and under the control of the Board of Directors.

The Executive Committee may act on such specific matters within the competence of the Board of Directors as may be delegated to it by a majority vote of the Board of Directors, except with respect to: (i) approval of any action for which shareholders’ approval is also required; (ii) the filing of vacancies in the Board of Directors; (iii) the amendment or repeal of these By-Laws or the adoption of new bylaws; (iv) the amendment or repeal of any resolution of the Board of Directors which by its express terms is not so amendable or repealable; and (v) the distribution of cash dividends to shareholders.

The act of the Executive Committee on any matter within its competence shall be valid if (i) it is approved by the majority vote of all its members in attendance at a meeting duly called where a quorum is present and acting throughout, or (ii) it bears the written approval or conformity of all its incumbent members without necessity for a formal meeting.

The Executive Committee shall hold its regular meeting at least once a month or as often as it may determine, in the principal office of the Corporation or at such other place as may be designated in the notice, or through remote communication in accordance with relevant laws, rules and regulations. Any member of the Executive Committee may, likewise, call a meeting of the Executive Committee at any time. Notice of any meeting of the Executive Committee shall be given at least seven (7) business days prior to the meeting or such shorter notice period as may be mutually agreed. The notice shall be accompanied by (i) a proposed agenda or statement of purpose and (ii) where possible, copies of all documents, agreements and information to be considered at such meeting.

Committee Members

| Office | Name | Date of Appointment |

No. of Meetings Held |

No. of Meetings Attended |

% |

|---|---|---|---|---|---|

| Chairman (ID) | Gemilo J. San Pedro | April 23, 2021 | 3 | 3 | 100% |

| Member | Val Antonio B. Suarez | April 23, 2021 | 3 | 3 | 100% |

| Member (ID) | Jonathan T. Gotianun | April 23, 2021 | 3 | 3 | 100% |

| Member (NED) | Efren C. Gutierrez | April 23, 2021 | 3 | 3 | 100% |

*Committee members are appointed annually.

The Board shall constitute an Audit and Risk Management Committee to be composed of at least three (3) qualified non-executive directors, preferably with accounting and financial background, majority of which shall be independent and should have related audit experience.

The Chairman of this Committee should be an independent director. He should inculcate in the minds of Board members the importance of management responsibilities in maintaining a sound system of internal control and the Board’s oversight responsibility.

The Audit and Risk Management Committee shall have the following duties and responsibilities:

(a) Internal Audit

- Recommend the approval of the Internal Audit Charter (“IA Charter”), which formally defines the role of Internal Audit and the audit plan as well as oversees the implementation of the IA Charter;

- Provide oversight financial management functions specifically in the areas of managing credit, market, liquidity, operational, legal and other risks of the Corporation, and crisis management;

- Provide oversight of the Corporation’s internal and external auditors;

- Review and approve audit scope and frequency, and the annual internal audit plan;

- Discuss with the external auditor before the audit commences the nature and scope of the audit, and ensure coordination where more than one (1) audit firm is involved;

- Set up an internal audit department and consider the appointment of an internal auditor as well as an independent external auditor, the audit fee and any question of resignation or dismissal;

- Monitor and evaluate the adequacy and effectiveness of the Corporation’s internal control system;

- Receive and review reports of internal and external auditors and regulatory agencies, where applicable, and ensure that management is taking appropriate corrective actions, in a timely manner, in addressing control and compliance functions with regulatory agencies;

- Review the quarterly, half-year and annual financial statements before submission to the Board with particular focus on the following matters:

- Any change/s in accounting policies and practices

- Major judgmental areas

- Significant adjustments resulting from the audit

- Going concern assumptions

- Compliance with accounting standards

- Compliance with tax, legal and regulatory requirements

- Coordinate, monitor, and facilitate compliance with existing laws, rules and regulations;

- Evaluate and determine non-audit work by external auditor and keep under review the non-audit fees paid to the external auditor both in relation to their significance to the auditor and in relation to the Corporation’s total expenditure on consultancy. The non-audit work should be disclosed in the Annual

- Report; and

- Establish and identify the reporting line of the Chief Audit Executive (CAE) so that the reporting level allows the internal audit activity to fulfill its responsibilities. The CAE shall report directly to the audit Committee functionally. The Audit committee shall ensure that the internal auditors shall have free and full access to the Corporation’s records, properties and personnel relevant to the internal audit activity, and that the internal audit activity should be free from interference in determining the scope of internal auditing examinations, performing work, and communicating results, and shall provide a venue for the Audit Committee to review and approve the annual internal audit plan.

(b) Risk Management

- Develop and oversee the Corporation’s risk management program;

- Oversee the system of limits to discretionary authority that the Board delegates to the Management, ensure that the system remains effective, that the limits are observed and that immediate corrective actions are taken whenever limits are breached;

- Advise the Board on its risk appetite levels and risk tolerance limits;

- Assess the probability of each identified risk becoming a reality and estimates its possible significant financial impact and likelihood of occurrence;

- Provides oversight over Management’s activities in managing credit, market, liquidity, operational, legal and other risk exposures of the corporation. This function includes regularly receiving information on risk exposures and risk management activities from Management; and

- Report to the Board on a regular basis, or as deemed necessary, the Corporation’s material risk exposures, the actions taken to reduce the risks, and recommends further action or plans, as necessary;

- Performs other duties and responsibilities as the Committee may deem appropriate within the scope of its primary functions or as may be assigned by the Board; and

Other duties and responsibilities are provided in the Audit and Risk Management Committee Charter.

Committee Members

| Office | Name | Date of Appointment |

No. of Meetings Held |

No. of Meetings Attended |

% |

|---|---|---|---|---|---|

| Chairman (ID) | Val Antonio B. Suarez | April 23, 2021 | 1 | 1 | 100% |

| Member | Lourdes Josephine Gotianun-Yap | April 23, 2021 | 1 | 1 | 100% |

| Member | Jonathan T. Gotianun | April 23, 2021 | 1 | 1 | 100% |

| Member (ID) | Gemilo J. San Pedro | April 23, 2021 | 1 | 1 | 100% |

*Committee members are appointed annually.

The Compensation Committee is composed of at least three (3) Director-members, two (2) of whom must be independent directors.

Duties and Responsibilities:

- Establish a formal and transparent procedure for developing a policy on executive remuneration and for fixing the remuneration packages of corporate officers and directors, and provide oversight over remuneration of senior management and other key personnel, ensuring that compensation is consistent with the Corporation’s culture, strategy and control environment.

- Designate amount of remuneration, which shall be in a sufficient level to attract and retain directors and officers who are needed to run the Corporation successfully.

- Establish a formal and transparent procedure for developing a policy on executive remuneration and for fixing the remuneration packages of individual directors, if any, and officers.

- Develop a form on Full Business Interest Disclosure as part of the pre-employment requirements for all incoming officers, which, among others, compel all officers to declare under the penalty of perjury all their existing business interests or shareholdings that may directly or indirectly conflict in their performance of duties once hired.

- Disallow any director to decide his or her own remuneration.

- Provide in the Corporation’s annual reports and information and proxy statements a clear, con-cise and understandable disclosure of the compensation of its executive officers for the previous fiscal year and ensuing year.

- Review the existing Human Resources Development or Personnel Handbook, to strengthen provisions on conflict of interest, salaries and benefits policies, promotion and career advancement directives and compliance of personnel concerned with all statutory requirements that must be periodically met in their respective posts.

Committee Members

| Office | Name | Date of Appointment |

No. of Meetings Held |

No. of Meetings Attended |

% |

|---|---|---|---|---|---|

| Chairman (ID) |

Val Antonio B. Suarez |

April 23, 2021 |

2 |

2 |

100% |

| Member |

Jonathan T. Gotianun |

April 23, 2021 |

2 |

2 |

100% |

|

Member (ID) |

Ernesto S. De Castro |

April 23, 2021 |

2 |

2 |

100% |

|

Member (ID) |

Gemilo J. San Pedro |

April 23, 2021 |

2 |

2 |

100% |

The Corporate Governance Committee shall assist the Board in fulfilling its corporate governance and compliance responsibilities. The Committee shall be composed of the Chairman of the Board and at least three (3) members of the Board, all of whom shall be independent directors. The Chairman of the Committee shall be an independent director.